Both the start and the change to freelancing involve some hurdles. To be successful as a freelancer, it is important to plan exactly how to get started and how to best overcome any hurdles that may arise. We will give you an insight into our many years of experience in project work with freelancers, show you concrete steps to get started and give you an understanding of bureaucratic formalities, financial and cultural differences as well as professional necessities.

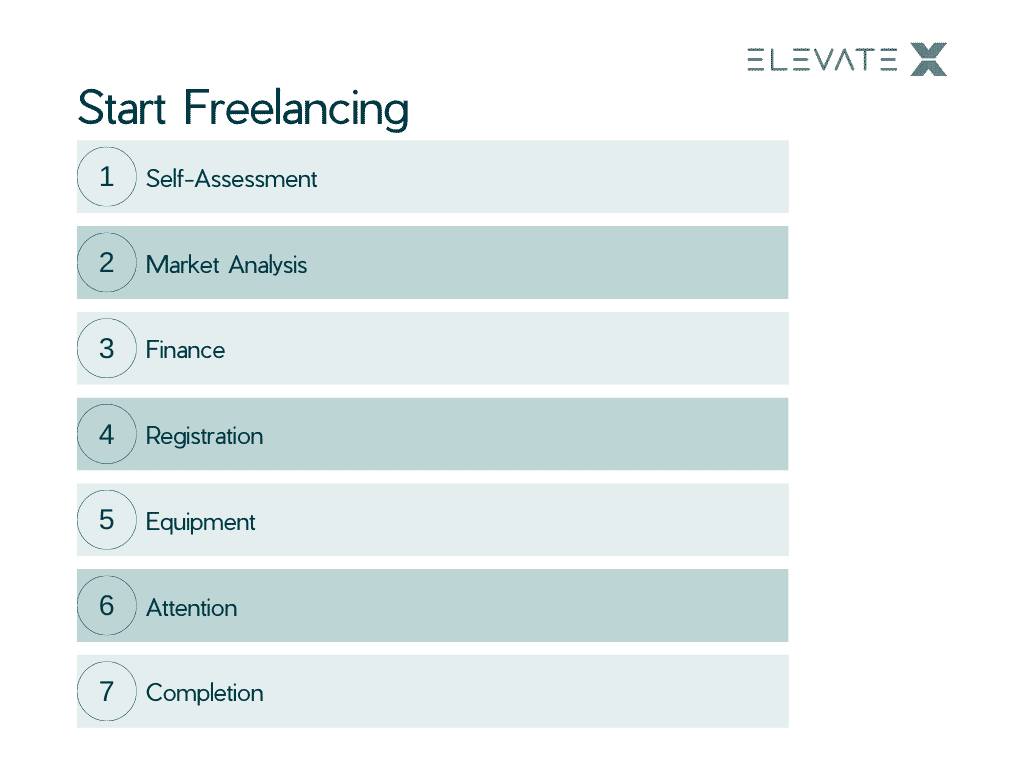

Becoming a Freelancer - These Are The 7 Steps

Step 1: Self-Assessment

If you are thinking of starting freelancing, you should think about what your skills are and in which areas you want to work. Also, try to solve possible problems of clients for which they might need your help.

Step 2: Market Analysis

Make yourself clear how the market in your industry looks like and how it could develop in the future. Are freelancers needed in this area at all? What is the competition like? What are possible target groups? The more precisely you study the market, the better you can assess opportunities and risks.

Step 3: Finances

You should be aware that freelancing is not the same as permanent employment, especially from a financial point of view. Above all, you are taking a greater risk and are responsible for yourself. Therefore, you should keep an eye on your finances. What hourly rate do I need to be financially secure? Is this realistic within my industry? What costs do I have to cover? A big advantage: As a freelancer, you are exempt from the trade obligation and therefore do not have to pay trade tax. Also, you do not need double-entry bookkeeping, but a simple income statement is sufficient.

Step 4: Registration

Since you are, as already mentioned, exempt from the trade obligation, simple information to the tax office is sufficient. You should have done this no later than four weeks after starting your business. You need the following information:

- First and last name

- Address

- Contact details

- Date of the beginning

- A short description of the activity

- Tax identification number

The letter is informal and cannot be submitted online. Subsequently, you will receive a questionnaire for tax registration.

Step 5: Equipment

If you have worked in your desired environment before, you should be familiar with hardware and software requirements. As a freelancer, however, you don’t have a fixed workplace and usually work remotely or in a home office. Read this article to learn how to set up a productive workspace in your own four walls.

Step 6: Generate Attention

A meaningful online presence is one of the most important points. Set up profiles on popular business networks such as LinkedIn or Xing so that you can be found there. Also, your website, which presents your references, experience, and knowledge is often a professional tool. Finally, freelance platforms such as ElevateX are also recommended. There you can find exciting projects, and we guarantee a smooth cooperation with well-known clients.

Step 7: Closing

Once you have completed a project, you need to write an invoice. Pay attention to the usual mandatory information and leave as little room as possible for questions. Communicate openly!

If you got the project through ElevateX, we will clarify financial aspects together and be your contact person.

Working as a Freelancer

Why Become a Freelancer?

Freelancer employment provides various benefits. For instance, having the flexibility and freedom to work whenever and wherever you want. Many people are drawn to the occupations because of their ability to make their own decisions. But not everyone is a good fit for freelancing. After all, doing remote or freelance work comes with a lot of hazards.

Advantages:

- Free order choice

- Flexibility

- Varied Tasks

- Influence on payment

- Compatibility of work and family, work-life balance possible

What Bureaucratic Hurdles Do Freelancers Have to Overcome?

Once the activity has been recognized as a freelancer, the registration is official. Every applicant then receives a tax number and is registered as a freelancer. With this, one is only liable for income tax and must submit a profit and loss statement for the annual financial statement. What exactly is the bureaucracy? This is due, for example, and above all, to the so-called status determination procedure. Here is a short excerpt from our guide on the subject of false self-employment:

In a status determination procedure, the actual status of a contractor as self-employed or employee can be checked by the clearing office of the German Pension Insurance Association. This examination for false self-employment can be requested by the German Pension Insurance Association, a local court, the tax office, or social security agencies. In principle, contractors or clients can also request an examination of false self-employment, for example, if a contractor wishes to sue for protection against dismissal or a client wishes to terminate a contractual relationship. In most cases, however, both parties are uninvolved and a third party, such as the health insurance company, requests an examination of the false self-employment because it wants to demand additional contributions.

If this status determination procedure results in the freelancer or the client not having worked properly or possibly even having deliberately accepted false self-employment, high penalties can follow for both parties.

In our guide to false self-employment, we delve deeper into the topic of false self-employment and explain specific excerpts from the federal statute book. In addition, we have explained more general points about false self-employment in this blog article.

Incidentally, our analysis of the legal situation on the topic of status determination procedures is consistent with the warnings of the Alliance for Self-Employed Knowledge Work (ADESW), among others: “Germany cannot and must not afford to bully these knowledge workers in a legal gray area and hinder them with increased bureaucratization.“

How Much Do You Earn as a Freelancer?

Your hourly fee as a freelancer is affected by a wide range of things. Consequently, it is challenging to draw general conclusions from this. The age of freelancers shows that those between the ages of 40 and 49 earn the highest hourly wages of more than 95 euros. Younger people start out with lower salaries since they have less professional experience. The rates then start to decline again as you become older; the average hourly rate for freelancers over 69 is only 84 euros. Women who work as independent contractors, regardless of age, are treated less favorably than their male counterparts.

It’s critical to take into account and factor in all personal and professional expenses when figuring up the hourly rate. The average freelancer hourly wage in Germany is 93.89 euros net. In general, the monthly income is 6,922 euros. You can get started by looking at this illustration. However, you must also take into account other crucial elements when performing the calculation:

- List of working days

- The difference between profit and sales

- Take into account the cost of social security

Now that you are aware of the expenses to consider when figuring out your hourly rate as a freelancer. There are more techniques that can aid in the calculation. When determining your hourly fee as a freelancer, you need also take into account your competition and your clients in addition to your expenses.

What Financial Advantages and Disadvantages Do I Have as a Freelancer?

A core element of the financial aspects that must be taken into account when entering freelancing is, in addition to the differing tax situation, retirement provision. Due to the steadily decreasing pension level, some investments, including paying into the pension fund, are questionable. The number of Germans who become self-employed is increasing. Freelancers, even more than permanent employees, need to examine numerous options for providing for old age and start making provisions at an early stage.

Especially due to the ongoing low-interest phase and the decreasing pension level, alternative asset classes are of great importance for a long-term and secure retirement provision. In a blog article on the topic of retirement planning for freelancers, we went into great detail about different asset classes, including various types of pension insurance, stocks, commodities, and cryptocurrencies. Every freelancer should start thinking about retirement planning early. Often, voluntary payments of statutory contributions are not enough to live well in old age. A well-thought-out strategy and investment, which is based on several pillars, is therefore sensible for all freelancers and also beyond. All forms of investment are associated with risks and advantages and disadvantages, which is why diversification and the establishment of multiple sources of income are essential for retirement planning.

In addition to the pension, the correct calculation of hourly rates is also important. Logically, the hourly rates of freelancers must be significantly higher than those of permanent employees. This is due, for example, to the fact that they have to provide for their retirement completely themselves, but also to higher risks, as freelancers bear entrepreneurial risks themselves. Here we have compiled five tips for freelancers on how to successfully negotiate the hourly rate and what to look out for.

What Cultural Characteristics Do Freelancers Live With?

The basic rule is that whether you are a freelancer or a permanent employee, the projects hardly differ, at least from a purely technical point of view. For example, organizations face the same challenges in both app and web development. In this respect, the same skills are needed to get involved in projects. Differences arise on two fronts: First, the permanent employee is already working for the company, while the freelancer must first go through an application process. Secondly, freelancers are not dependent on instructions, i.e., they owe the contractual partner a service, how exactly they fulfill this is irrelevant, as long as all contractually stipulated clauses are taken into account.

Freelancers are responsible for project acquisition. This includes everything from your own marketing, for example, to a successful LinkedIn profile, to technical interviews. We have linked you to an article from our knowledge base on how to present yourself on LinkedIn and how to master technical interviews in the best possible way.

In terms of professional skills, independent continuing education is also of enormous importance. Freelancers have the reputation of always being up-to-date and finding innovative solutions to problems. In this respect, independent learning of relevant innovations is enormously important. In this way, one offers the greatest possible value to corporate clients and qualifies oneself for future collaborations. Ideally, you have some good sources, which you look at several times a week, so you do not miss any innovations and educate yourself specifically in the field. You can find some examples of good sources here in our overview on this topic.

How Does a Freelancer Work?

You are your own boss if you perform freelance work for a variety of clients. This indicates that you typically have the freedom to choose how, when, and where you work. Most independent contractors benefit from this independence by experimenting with various working paradigms. These, for instance, include:

- having a workplace

- office at home

- a coworking space

Digital nomads are freelancers who are able to work from anywhere and do so frequently. A young individual with tanned skin lounging on a tropical beach, drinking a cocktail, and working casually, almost on the side is the traditional image of a digital nomad. Indeed, for many people, this is the ideal scene. Only a select handful, nevertheless, are able to live and work in this manner. In addition, freelancers work an average of 42 hours per week and have an estimated average of 27 days vacation per year.

Should Professional Differences Be Expected When Switching to Freelancing?

The basic rule is that whether you are a freelancer or a permanent employee, the projects hardly differ, at least from a purely technical point of view. For example, organizations face the same challenges in both app and web development. In this respect, the same skills are needed to get involved in projects. Differences arise on two fronts: First, the permanent employee is already working for the company, while the freelancer must first go through an application process. Secondly, freelancers are not dependent on instructions, i.e., they owe the contractual partner a service, how exactly they fulfill this is irrelevant, as long as all contractually stipulated clauses are taken into account.

Freelancers are responsible for project acquisition. This includes everything from your own marketing, for example, to a successful LinkedIn profile, to technical interviews. We have linked you to an article from our knowledge base on how to present yourself on LinkedIn and how to master technical interviews in the best possible way.

In terms of professional skills, independent continuing education is also of enormous importance. Freelancers have the reputation of always being up-to-date and finding innovative solutions to problems. In this respect, independent learning of relevant innovations is enormously important. In this way, one offers the greatest possible value to corporate clients and qualifies oneself for future collaborations. Ideally, you have some good sources, which you look at several times a week, so you do not miss any innovations and educate yourself specifically in the field. You can find some examples of good sources here in our overview on this topic.

If you want to learn more about working as a freelancer with ElevateX, you can learn more and register here.