Payroll accounting is a complex task and requires a lot of attention and structure to be done reliably. Especially for companies that operate internationally, many legal principles must be observed. So-called payroll providers or payroll services take on this task and simplify it through automation. They are experts in payroll accounting and thus relieve the HR (Human Resource) department.

But what exactly does a payroll provider do? What are the benefits of outsourcing? And why are freelancers a practical alternative that many don’t have on their radar?

What Does “Payroll” Mean?

Literally translated, “payroll” means wage or salary accounting. The HR department usually takes care of employees’ payroll and ensures that they receive it on time and on a regular basis. In addition, there are formal matters such as tax and insurance deductions.

In international companies in particular, this task is often very demanding, as close attention must be paid to the employees’ locations and the legal requirements there. For this reason, many corporate HR departments look for a payroll service that specializes in such tasks and has excellent knowledge of legal aspects.

Usually, there is also payroll software that assists HR staff with payroll.

How Does Payroll Work?

Payrolling keeps track of who works for a company and how much they are paid. Pay also includes non-cash perks, non-wage labor costs, and social security contributions under financial and tax law. Three steps make up the payroll procedure:

- Gathering all necessary employee information and paperwork for payroll.

- Figuring out the pay, taxes, and social security contributions.

- Notifying social security organizations, completing the month, transferring funds, posting transactions to the financial accounting department, and distributing paychecks to employees.

Both internally and outside, a large number of people are involved in this process: personnel from human resources, payroll accountants, tax consultants, as well as workers from the tax office and social insurance agencies. Payroll is greatly complicated as a result.

Goals Of Payroll

The goal of a payroll is to capture, manage, prepare, and process relevant employee compensation data, while considering all tax and social security aspects. The effort involved in payroll processing should be minimized, and errors should be largely avoided.

What Is a Payroll Manager?

Due to the numerous changes, payroll staff not only need to be well-versed in labor, social security, and tax law, but they also need to keep up with complicated regulations and processes. Payroll managers should be aware of agreements that supervisors and other HR managers make without having a solid understanding of the law in order to shield the business, the board of directors, or senior management from possible legal repercussions.

A Payroll Manager or Payroll Specialist is a person who manages payroll professionally. The processing of payroll accounting is handled by payroll managers or specialists. They have to manage special payments and bonuses in addition to monitoring deadlines and regulatory requirements. Timekeeping and keeping track of each employee’s working hours and absences are also included in payroll management.

In addition to managing payroll, payroll managers frequently carry out basic administrative tasks and, depending on the size of the business, may also manage financial accounting. They are responsible for:

- payroll preparation and management

- adherence to collective bargaining rules, as well as social security and tax payment requirements

- correspondence with the departments and institutions of social security

- supporting audits of social security and payroll taxes

- creating reports for the human resources department

- retaining personnel files and maintaining personnel master data

- review of the rules governing collective bargaining

- assistance for the accounting division

Payroll managers must have completed a commercial apprenticeship before being hired. Additionally, extra training might be used to get a job at the organization. Even seasoned payroll administrators require regular training to stay abreast of legal and technical advancements. Salary ranges from EUR 32,300 to EUR 54,900 and depends on experience, geography, and level of responsibility.

What Does a Payroll-Service Do?

A payroll service provider is a company that handles some or all the tasks associated with payroll. Companies rely on such service providers to ensure that employees receive their payroll on time and on a regular basis. In addition, payroll services take care of legal aspects of payroll, which can help avoid penalties that might otherwise result from ignorance.

The tasks of a payroll service are manifold:

Automatic Payroll Accounting

Payroll service providers take care of the automation of payroll accounting. In this way, it does not have to be sent by hand, but the payroll is automatically sent to all employees on a specified day of the month. By automating such processes, the time spent on calculating wages, for example, is significantly reduced.

Tax Matters

Automated systems ensure that all taxes and other employee payroll deductions are complied with and paid on time to appropriate authorities.

Service for Employees

In the personal area for each employee, they can view all important and essential documents relating to payroll accounting. There, they can change personal data without the need for supervisors to act.

Information

If there are any changes regarding payroll within the country concerned, the payroll service informs the HR department. As a rule, the providers also incorporate the changes into the automations.

Time Documentation

Especially in the home office or with remote work, time documentation is particularly important to be able to separate private and professional matters. For insurance reasons, this is a key point for companies should injuries occur during working hours.

The service of a payroll provider usually includes a time tracking tool, which also transfers the recorded hours directly into the payroll.

Setup of Payroll Accounting

Especially with foreign employers, accounting can be costly and time-consuming. The legislation is also often not entirely clear and requires a lot of research. For example, foreign companies must pay taxes and social security contributions for their employees, even if they do not have a branch in Germany.

Why Are Payroll Services Useful?

More companies tend to outsource the tasks for payroll and payroll accounting to create capacity for the HR team.

Efficiency

By outsourcing payroll, HR professionals have more capacity for other tasks. Since the Payroll Services are experts in their field, they know exactly what matters and ensure the safety and the correctness of the payroll.

Security

Payroll services are well versed in the legal and statutory aspects relating to their area of responsibility. As a result, careless mistakes can be avoided and the company is spared penalties.

Payroll service providers also guard against data protection problems and protect sensitive data of employees and the company.

Software

All automations run via the software of a payroll service, and all employee data is available centrally in one place. This means that all authorized persons have access to the data, which can be downloaded as often as required without being lost. The software also records the time recording and documentation of the work steps.

Which Payroll-Services Exist?

ICS Payroll

ICS Payroll handles all aspects of payroll accounting for companies. The advantage is that HR managers can decide whether they want to outsource the entire process or only certain areas. The ICS Payroll system is modular, and HR staff can choose the modules they want to outsource.

ADP

In addition to outsourcing for payroll, ADP’s offering also includes other useful HR tools. They offer a comprehensive service with experts to provide fast and reliable help with questions close to the customer and problems.

Gusto

The payroll provider Gusto also offers a lot of support and many services that provide relief for the HR department. These include things like hiring and onboarding support, time tracking and talent management.

Paychex

Paychex is one of the leading payroll providers for medium-sized businesses in Germany. They deliver a complete package for the complete outsourcing around payroll accounting with all important documents.

Why Freelancers Can Help

As explained in one of our last posts, freelancers are suitable for many purposes due to their flexibility, but often they are still not properly perceived as an alternative.

Easy Handling

Since freelancers write the invoice themselves and are also responsible for their own payroll, no tasks fall on the company other than signing the contract and paying the invoice. This means that the HR department does not have to worry about the freelancer’s payroll.

Learn more about working with freelancers: https://elevatex.de/resources/ebook-how-to-successfully-work-with-freelancers/

Cost Efficiency

While with a permanent employee many other things must be considered in addition to the hourly rate, only the pure hourly rate is a cost for the freelancer. Costs that must be borne by permanent employees are, for example, vacation days, hardware, insurance, and training.

More information about costs for freelancers can be found in this article.

Pure Working Time

The weekly hours of freelancers are also precisely documented, as they are used for billing. In addition, freelancers do not take vacation during their work with the company and do not have any absences (except in exceptional cases).

Here you can read what other advantages freelancers can bring to a company.

Fast Onboarding

We also discussed the topic of onboarding in detail in our last article. The advantage of freelancers is that they can be integrated into the current project quickly and easily after starting work. Freelancers are accustomed to quick project changes and adjust to working together efficiently.

While the training period for permanent employees is quite high, freelancers stand for efficiency and productivity.

Hybrid Teams

The use of freelancers does not exclude cooperation with permanent employees, but promotes efficiency and productivity. So-called hybrid teams of permanent employees and freelancers have many advantages. Find out more in our free factsheet.

Why Are Payroll Systems Important For Companies?

Payroll processing is a complex process involving multiple stakeholders. Constant changes in tax and social security laws make it difficult to standardize procedures. Companies with complex compensation systems require efficient payroll management to ensure compliance with standards and regulations. Therefore, payroll is often separated from the HR department and outsourced to tax consultants. However, tax consultants rely on comprehensive information to generate accurate payroll calculations. A payroll system can automatically transfer data between HR and external service provider systems, minimizing effort and error rates.

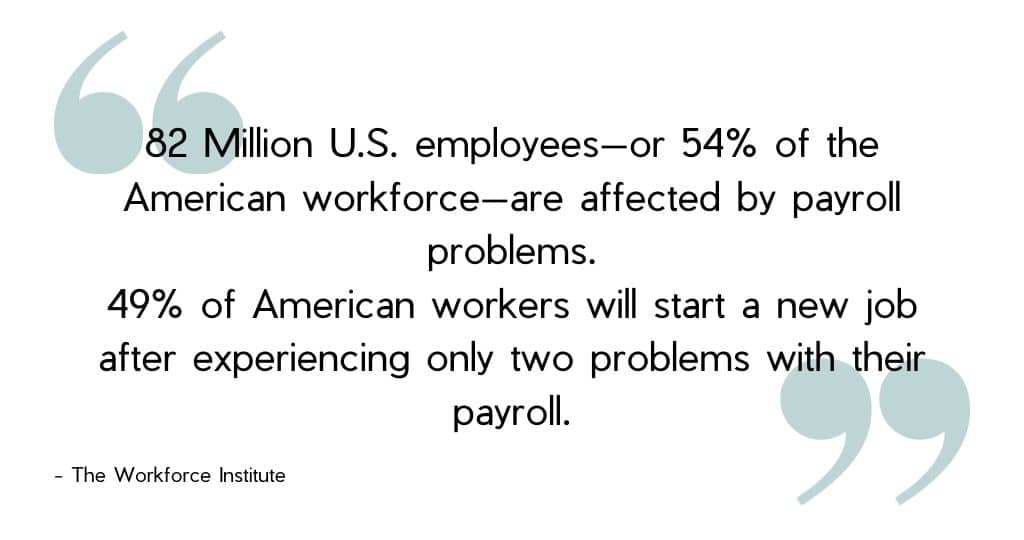

Flexible employment arrangements pose a particular challenge for payroll processing. This trend is expected to increase further in light of the challenging economic environment. Companies are increasingly working with freelancers or utilizing temporary labor to respond flexibly to their workload. Numerous standards and laws, particularly regarding false self-employment and obligations in temporary staffing, must be observed. Complex questions regarding minimum compensation and insurance obligations also arise when employing on-call staff.

For international companies, additional challenges arise in payroll processing. Payroll experts must consider the legal requirements of different locations, as each country has its own tax, wage, and social systems. There are now global and flexible payroll systems that can meet these requirements.

Conclusion

Payroll services are a useful addition to almost any company. Especially for international companies, where the requirements and laws in each country can be different, experts in this field are extremely helpful.

But also in this case, it can be helpful to think about the use of freelancers. Especially for temporary assignments and projects, the use of freelancers is usually the best option. The uncomplicated handling, the simple payment and the high efficiency in cooperation with permanent employees is a useful addition to every team and additionally provides relief for the HR department.

Learn more about working with freelancers and how to approach it successfully in our free eBook.

Are you looking for the perfect IT freelancer for your team? Here you can send us a free request.

Payroll refers to the calculation and processing of wages and salaries for employees. It includes all payments made to them.

Payroll systems are crucial for enhancing a company’s capabilities and employee retention. They also ensure compliance with legal regulations related to employment relationships.

A Payroll Specialist or Payroll Manager is responsible for managing payroll accounting. They must adhere to deadlines and legal requirements, as well as manage special payments and bonuses.