Numerous cases show: The risks associated with false self-employment are omnipresent. Just a few years ago, for example, a major German car manufacturer had problems with the judiciary precisely because of this. How to solve risks related to false self-employment, what the German car manufacturer is all about and how to consequently start successful collaborations with freelancers, you will read with us.

1. What Is False Self-Employment?

Is False Self-Employment Dangerous?

If not taken care of, false self-employment can be a danger for freelancers and companies that use freelancers. The status of freelancer will be revoked. The contractor will become an employer and will have to pay social security contributions retroactively. Other penalties may follow as well. Checks on freelancers or freelancers with a view to false self-employment have increased in recent years. Reason enough to deal comprehensively with the topic of false self-employment. Accordingly, we share our many years of experience and best practices in this area.

False self-employment represents an employment relationship in which a contractor working on a contractually independent basis is, according to the criteria of the authorities, a classic employee. This indicates that he would have to be registered as such, subject to social security contributions. Non-compliance with the laws regarding false self-employment can cost both client and contractor their livelihood, should one of the bodies entrusted with the control uncover the false self-employment.

Translation of the German Pension Insurance’s definition of false self-employment (Source: Lexikon zur Sozialversicherungsprüfung im Unternehmen):

“Pseudo-self-employed persons are persons who formally appear as self-employed (contractors), but are in fact dependent employees within the meaning of Section 7 (1) SGB IV.”

What Exactly Is the Problem?

In a status determination procedure, the clearing office of the German Pension Insurance Association can check the actual status of a contractor as self-employed or employee. This check for pseudo-self-employment can be requested by the German Pension Insurance Association, a local court, the tax office or social security agencies. In principle, contractors or clients can also request an examination of false self-employment. This can occur, for example, if a contractor wishes to sue for protection against dismissal or a client wishes to terminate a contractual relationship. In most cases, however, both parties are uninvolved and a third party, such as the health insurance company, requests an examination of the false self-employment because it wants to demand additional contributions.

If this status determination procedure results in the conclusion that the freelancer or the client did not work properly or possibly even consciously accepted a false self-employment, high penalties can follow for both parties.

An excerpt (translated) from the German Federal Law from July 2019 shows how lawmakers view the issue of false self-employment:

“False self-employment leads to a lack of social security for the supposedly self-employed and puts a strain on the social systems. The inspection and investigation powers of the FKS will therefore be expanded in order to be able to carry out an inspection of the false self-employed person at the reported place of business or, if necessary, at an official location in the future in the event of suspicion of false self-employment, even without knowledge of the specific place of work, and to carry out investigations if necessary.” (FKS = Financial Control of Clandestine Employment of the Customs Administration)

In summary, it is clear that false self-employment must always be avoided and problems in this regard prevented. Both sides, i.e. the client and the contractor, are responsible for this and should adhere to rules and measures to prevent problems. Then nothing stands in the way of successful and goal-oriented cooperation between companies and freelancers. Already the ideas of a successful cooperation, which includes the avoidance of false self-employment, show how well two parties fit together. We will be happy to advise you on this.

By the way: In addition to a focus on avoiding false self-employment, the integration of freelancers into projects is also considered particularly important. We have written a blog article for you on this very topic.

2. What Criteria Must Be Observed Regarding False Self-Employment?

In order to know what to look out for when avoiding false self-employment, you should be aware of the criteria the authorities used to check for possible false self-employment. It is important to understand that there is no black or white in the current legal situation and jurisdiction. Every case, every check for false self-employment represents a case-by-case examination. Therefore, there are only helpful criteria and comparisons to other cases, on the basis of which one can analyze to what extent one as a company or freelancer could be affected by the problem of false self-employment.

Checks in this regard include both the control of the concluded contracts as well as the actual circumstances and conditions in everyday professional life. Auditors must, of course, find evidence of pseudo-self-employment and prove it. The following criteria, among others, are taken into account:

- Regular employment of employees who are not subject to compulsory insurance.

This is not a problem from a purely legal point of view. However, it has been shown that in companies with regular employment of employees who are not subject to compulsory insurance, cases of false self-employment are significantly more frequent. - Permanent contracts between both parties.

Freelancers often have contracts with a duration of 3-24 months. Particularly long, even permanent contracts set alarm bells ringing with the authorities. The reason for this is that the longer the duration of employment, the more money can be saved. - Dependence of a contractor on only one client.

Especially when the very largest part of the turnover is generated with one client alone. This point ties in with 3), if there is extreme dependence, logically independence no longer exists and self-employment can be doubted. - Regulated working hours.

As a self-employed person, one must perform certain services. The times often do not play an overriding role. Of course, certain appointments must be met, but otherwise the self-employed person is fundamentally only obliged to provide a service. - Correspondence with work instructions between freelancers and companies.

Here, too, the following applies: The self-employed person must perform a work, there is no dependence on instructions. A work contractor undertakes to produce an agreed work, not to perform a mere activity. The characteristic feature is the economic independence of the work contractor. Here also result some things that are important now in the home office. How to approach remote leadership the right way, you can read here in our blog article. - Low hourly rates that do not cover the costs of freelancers.

If, for example, there is a contract between a company and a freelancer, both companies save certain costs. At the same time, however, the freelancer must receive an hourly wage that is significantly higher than that of a permanent employee in order to cover his or her own costs, such as retirement benefits. - Involvement of the freelancer in decisions.

Is the freelancer bound in many decisions like sources of supply, use of personnel, use of capital, use of machinery? Basically, the freelancer is responsible for the production of a work, not to make certain decisions or to be bound in them.

Avoid Intransparency!

In Germany, there is a lot of intransparency and poor knowledge in the area of checking false self-employment. For years, companies that work with freelancers have been demanding that there be clear guidelines and laws regarding the issue of false self-employment. We at ElevateX also see a development towards greater transparency in this regard as inevitable.

The Association of Founders and Self-Employed People Germany e.V. (VGSD = Verband der Gründer und Selbstständigen Deutschland e.V) advocates clear criteria with regard to false self-employment and writes on its website:

“When no one can understand the criteria anymore and even social courts contradict each other in their rulings, something is fundamentally wrong. We want criteria that can be understood with common sense, a fast and transparent status determination procedure, and independent decision-making bodies – instead of more and more temporary work and relocation of projects abroad.”

3. What Are the Consequences of False Self-Employment?

All self-employed persons who do contract work can be affected. Freelancers or freelancers are particularly affected. The first consequence is the termination of self-employment and a subsequent start of employment as an employee. On the one hand, this gives a freelancer numerous rights, such as protection against dismissal or vacation entitlement, but at the same time he must face numerous negative consequences.

Such a constellation can be particularly difficult because most freelancers have made a very conscious decision to become self-employed. They do not want to be employed, and have, for example, adjusted their retirement provisions to self-employment. Here, an imposed employee relationship can put a spanner in the works.

Both the client and the contractor are legally regarded as joint and several debtors in the case of false self-employment. The previous client can therefore deduct the employee’s share of the additional social security contributions for the past three months from the future salary of the new employee. In addition, invoices issued by the contractor must be corrected if false self-employment is established. This includes, among other things, the sales tax shown, which is declared invalid. Finally, the input tax deduction must not have been made – if it has already been made, the input tax must be paid back to the tax office.

Are Contractors Also Exposed to the Risks of False Self-Employment?

As soon as false self-employment can be proven, both the client and the contractor must expect legal and financial consequences. In the case of the client, of course, all liability and payment obligations apply retroactively in the case of false self-employment, just as they do for normal employees. As a result, the client must pay social security contributions up to four years in arrears. In addition, there are possible late payment surcharges.

In the case of false self-employment, tax offices can also demand retroactive payment of back income tax. Here, too, the rule of up to four years retroactively applies. Should intentional false self-employment be proven, the parties involved may be subject to fines, prison sentences and demands for repayment for up to 30 years. Furthermore, the disclosure of sales tax on the invoices for the self-employed person is invalid, which means that the input tax deduction made is considered inadmissible, and the input tax amounts deducted must be corrected and repaid. As of the determination of the false self-employment, all rights that the employees of the company have applied to the previous contractor.

How to Not Approach False Self-Employment

Problem with the laws on false self-employment: For companies and freelancers, there is no clear thread in the law – there are no clear guidelines on “self-employed or false self-employed”. This lack of transparency often leads to problems. A suitable example of this is provided by a large automotive manufacturer, where two IT specialists who had formally worked there via contracts for work and services had successfully sued their way into the group as employees. In the proceedings at the time, the Baden-Württemberg Regional Labor Court deemed the contracts to be sham contracts for work and services and upheld the claim of the two IT specialists for a permanent employment relationship with the car manufacturer.

It is true that the two IT specialists were not freelancers, but temporary workers who were employed by other service providers via an employee leasing constellation. However, the effect was similar to that of freelancers – namely that the end customer was able to save on social security contributions through the apparent contracts for work. Already in 2013, at the time of the lawsuit, it was clear that many other companies could certainly face consequences and that controls would increase. It is therefore worth taking a closer look at the ruling of the Regional Labor Court.

The Regional Labor Court has confirmed well-known rulings of the Federal Labor Court on false contracts. Already known factors such as the regular and/or exclusive employment of persons over a long period of time in the company’s own premises or also the use of company-owned equipment played a role here. In the case of the automotive manufacturer, among other things, the instructions issued electronically to external employees counted as a decisive factor for the court ruling and show that instructions to freelancers should generally be refrained from as far as possible.

Other factors included the fact that the two IT specialists often worked fixed hours for the Group and were fully integrated into the company, for example with permanent employees. Accordingly, the specialists, working under contracts for work and services, fulfilled orders of a directive nature away from the ticket system, which the automaker used as a precautionary measure to prevent false self-employment. The two IT specialists’ claim for permanent employment was unsuccessful before the Stuttgart Labor Court. This adjusted itself however now an instance higher before the national labor court.

“For the legal demarcation of the work or service contract to the employee leasing, only the actual implementation of the contract is decisive,” reads a guiding principle of the judgment. The judges thus affirm that it is not legally decisive how the contracts with freelancers would formally look, it depends on how they are actually lived in practice. Furthermore, the fact that the automaker had never asserted warranty rights in recent years also indicates that the IT specialists were active in the company more than employees than as freelancers. According to the court’s reading, this indicates that the work services tended to be purchased rather than, as is ideally the case with freelancers, a work result.

Our tip:

As a freelancer, you should ideally never apply for a status determination procedure. The interest of the state is clearly that as many citizens pay into the pension fund. Freelancers usually have no interest in this. If the procedure is initiated by the pension or health insurance fund, one must endure the review.

4. How Can I Avoid False Self-Employment?

Ensure a Successful Collaboration!

In avoiding false self-employment, we ideally report from the joint work of ElevateX and our customers. For us, one of the first steps in a collaboration is to explain, if necessary, the risks of false self-employment. Thanks to our experience in working with freelancers, we know exactly and can accurately assess the extent to which certain types of collaboration might or might not pose a risk in terms of false self-employment.

You can read more about our successful collaboration in our success stories.

A successful cooperation, also in terms of reducing the risks of false self-employment, starts already in the first meeting between the freelancer and the client. Are both parties aware of the risks, do both parties know how to behave during the duration of the project?

The first meeting is followed by the project, provided it was successful, and the decision was made to work together. The basic building block for the start and also the end of each project is onboarding and offboarding. Here, too, things are discussed with regard to the avoidance of false self-employment. We have written a comprehensive blog article on the topic of on- and offboarding. You can find the blog article here.

Our CEO Sören Elser and our CTO Ralf Gehrer, who have both been working with or as freelancers themselves for many years, list their most important tips and tricks here and explain what to look out for in terms of false self-employment.

- Awareness

Companies need to develop an awareness of being able to recognize the differences between employees and freelancers. There are numerous differences, and it is simply wrong to think that one can “treat everyone the same” with regard to false self-employment. - Focus on result-oriented work

Companies and freelancers must pay close attention to the fact that no so-called authority to issue instructions exists. This means: focus on result-oriented work: As a company, we don’t care when, where and how someone works, but what results are needed and how they can be achieved as quickly as possible. - Location-independent working

Central to false self-employment is location-independent working. Of course, this does not always work, sometimes the presence of the freelancer on the company premises is indispensable. Nevertheless, location-dependent work is a strong indication of freelancing. - Hourly rates

In addition, companies, freelancers and possibly intermediate parties must work on hourly rates. In any case, the freelancer must earn more than an equivalent permanent employee. He simply has a completely different cost structure and has to take care of his pension 100% himself, for example. - Number of projects

Finally, it helps that the freelancer has more than one project per year. Ralf has mostly followed the 80/20 rule here – 80% of the revenue in the main project, 20% in another side project.

Best Practices for Ensuring a Successful Collaboration to Avoid False Self-Employment

Ignorance does not protect from punishment

It is important to note that ignorance does not protect you in the event of a penalty. As a self-employed person, you have a duty to obtain the necessary knowledge regarding the possibility of false self-employment and to avoid it. If you are not sure about the legal situation, find help from consultants or lawyers to clarify open questions and have legal certainty.

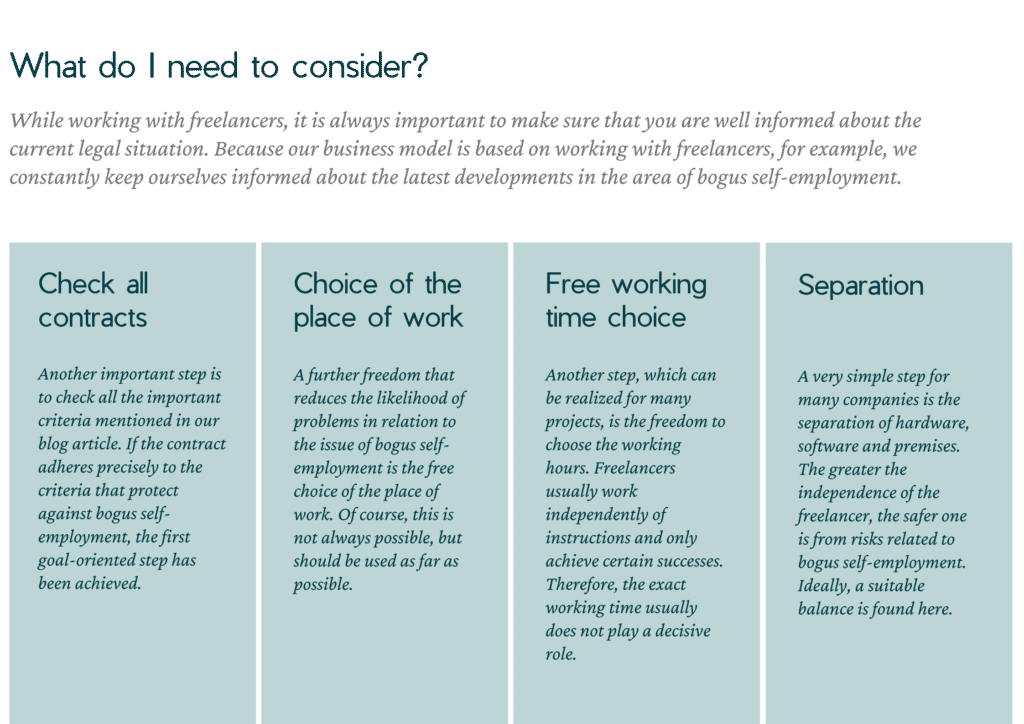

Review all contracts

All of the previously mentioned criteria must of course be checked against the daily work routine and the contracts. Do contractors have freedom of decision and bear their entrepreneurial risk? The contract should contain a reference to the fact that there is no obligation to give instructions to the freelancer. In addition, the contracts can also state that the contractor will regularly provide evidence of further assignments and self-insurance.

Separation of hardware, software and premises

Another step to prevent false self-employment is that companies and freelancers do not use the same hardware, software and premises, but are independent of each other.

Free choice of work location

The more freedom freelancers enjoy in a company, including the choice of work location, the lower the risk of false self-employment.

Free choice of working hours

In addition to the place of work, working hours are also one of the most important factors, since freelancers usually work independently of instructions and only achieve certain successes; when and how they get there should be up to them.

Although there is no crystal-clear legal situation on the subject of false self-employment, numerous indications can be used to protect oneself – whether as a company or as a freelancer.

Some questions should always be asked when signing a contract and in the actual implementation of an order – if these are answered “wrong”, the alarm bells should ring and think again about the planned cooperation:

- Does the contractor determine his working hours independently?

- Are the tasks of the contractor distinct from those of the permanent employees?

- Is there a dependency on instructions between the contractor and the client?

- Does the contractor appear as independent in the outside world?

- Is the contractor free from controls on the part of the client – for example in connection with hardware and software?

- Does the contractor have freedom regarding the reporting of services?

5. What Does ElevateX Do Regarding False Self-Employment?

Knowledge Transfer and Education on the Subject Matter

At ElevateX, we stand for sharing our knowledge with our friends, partners and customers. We see this as an all-encompassing benefit – for all parties. We provide our customers with valuable information already at the beginning of a possible cooperation, so that the cooperation runs smoothly and legally secure. Should there be any ambiguities or the like, we are available to advise our customers as well as freelancers. Thanks to our many years of expertise, we are able to assess a wide variety of situations and possible risks in connection with false self-employment and beyond.

Review of Fundamental Criteria

If, as explained above, far-reaching support on the subject of false self-employment is required, we review various criteria together with our clients and the freelancer. Here we do not deal with special or “secret” criteria, but with the very ones we presented to you before, for example the 80/20 limit. It is perfectly normal that during the first projects with freelancers, there may be some uncertainty regarding legal issues, such as false self-employment. We believe that this caution is appropriate, because it means that certain situations are double-checked and conclusively verified in a legally sound manner.

Do you have questions regarding a project and possible aspects related to false self-employment? Feel free to contact us, we will advise you and find the best solution for you and your project.

Top 3 Q&As About False Self-Employment

Here we show you the three most important questions that our customers and partners ask us most often.

Cases of false self-employment are often difficult to detect for companies and also freelancers. In this respect, it is extremely important to take steps to avoid cases of false self-employment. Otherwise, companies and freelancers may incur high costs.

For many, recognition is the real difficulty. In this respect, preventive measures are the be-all and end-all. This includes, for example, watertight contracts. A pseudo-self-employment exists if a freelancer is dependent on instructions, has to follow clear time and place specifications and uses hardware and software of the company.

The federal elections a few weeks ago have made it even clearer how the issue of false self-employment will develop. In this respect, the coming months will show whether the issue will be on the agenda of the next federal government or not. On a positive note, many associations and other organizations are fighting for a clear legal situation.

Here we offer you a comprehensive guide on how to recognize and avoid bogus self-employment. Nevertheless, we would like to point out that we cannot replace a lawyer and therefore cannot offer legal advice.