The world of self-employment can be confusing, especially when terms like “freelancer” and “Free Employees” are seemingly used interchangeably. But what are the actual differences between the two? In this blog post, we will clarify all your questions on this topic.

What Is A Freelancer?

Freelancers are independent professionals who work on a project basis for various clients. They are not tied to a specific company and, therefore, enjoy a high level of flexibility and autonomy. Next, we will highlight the key characteristics and advantages that define freelancers.

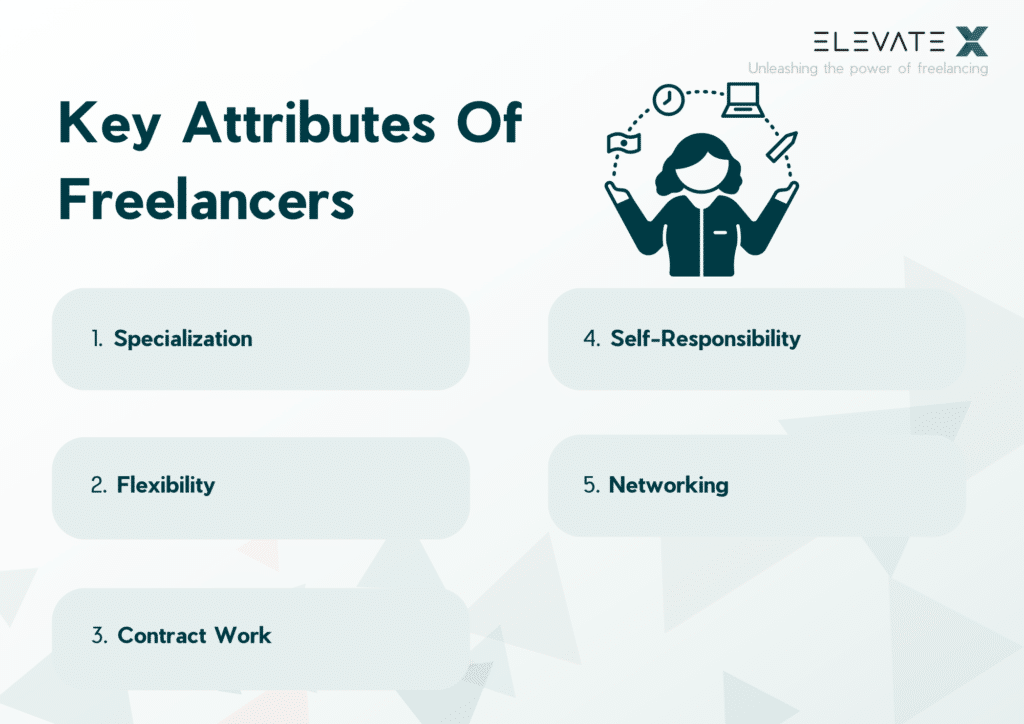

Key Attributes Of Freelancers

- Specialization: Freelancers are often experts in specific fields such as software development, data analysis, or graphic design. Their specialization makes them valuable resources for companies that need to perform specific, often highly skilled tasks.

- Flexibility: One of the most notable benefits of working as a freelancer is flexibility. They have the freedom to choose their own working hours, can work from anywhere, and often have the ability to select the type of projects they want to work on.

- Contract Work: Freelancers typically work based on contracts that clearly define the details of expected services, the timeframe, and compensation. These contracts can be short-term for small tasks or medium- to long-term for more extensive projects.

- Self-Responsibility: Freelancers are responsible for their own accounting, taxes, and insurance. This requires a high level of organization and entrepreneurial thinking.

- Networking: Since freelancers work for a variety of clients, they have the opportunity to build an extensive professional network that can open up future business opportunities.

Benefits For Companies

- Cost Efficiency: Since freelancers are not considered permanent employees, companies save costs on benefits, office equipment, or training.

- Access to Specialized Skills: Companies can quickly access specialized skills without having to hire someone permanently. This is especially useful for projects that require specific expertise not available within the company.

- Quick Implementation: With freelancers, projects can often be completed more rapidly as they are typically available immediately and can adapt flexibly to the project’s requirements.

KEY POINTS

Freelancers are independent professionals who work on a project basis for various clients.

They often specialize in specific areas and are responsible for their own accounting.

A free employee is a person who engages in self-employed, freelance work and is not in an employee relationship.

They have longer-term client relationships and are exempt from business taxes.

What Is A Free Employee?

A free employee is a person who works in independent freelance activities and is not in an employee relationship. Working as a free employee is possible in many industries, including IT, engineering, arts and culture, healthcare, and many more. In this section, we will delve into the characteristics and benefits of free employee status in more detail.

Characteristics Of A Free Employee

- Independence: Free employees typically work independently and are responsible for their own work organization, accounting, and tax matters.

- Free Professions: Free employees usually practice what is known as a “free profession.” This includes professions such as doctors, lawyers, tax consultants, architects, journalists, artists, teachers, and engineers, among others.

- Professional Qualification: Free employees generally have the appropriate professional qualifications or education required for their profession. This qualification can be obtained through a degree, an examination, or specialized training.

- Creative Work: Many free employees work in creative professions where their individual expertise and creative skills are in demand, such as designers, writers, or musicians.

- Client Portfolio: Unlike employees who usually work for a single company, free employees often have multiple clients. This allows for a broader network and reduces financial dependence on a single client.

- Contracts and Agreements: Collaboration is typically governed by contracts that outline services, payment, and other conditions.

Benefits Of Being A Free Employee

- Flexibility: One of the biggest advantages is work flexibility. Free employees can, in coordination with their clients, largely determine their working hours and locations.

- Diverse Projects: The opportunity to work on a wide range of projects keeps the workday exciting and allows for continuous learning and growth.

- Financial Control: Free employees can set their own prices and often have the potential to earn a higher income than in a fixed employment.

The Difference Between A Freelancer And A Free Employee

In the working world, you often hear the terms “Freelancer” and “Free Employee,” and although they sound similar and are often used interchangeably, there are significant differences. In this section, we will shed light on what sets these two terms apart and how they differ in terms of status, legal aspects, work methods, and more.

Status And Legal Aspects

- Definition: A free employee is defined by law in Germany and is subject to specific tax and social security regulations. In contrast, “Freelancer” is a less strictly regulated term originating from the English-speaking world.

- Catalog Professions: Free employees often work in so-called catalog professions listed in the Income Tax Act. These include, for example, doctors, lawyers, and engineers. Freelancers, on the other hand, can work in a variety of fields that are not necessarily legally defined.

- Trade Tax: Free employees in Germany are exempt from trade tax, while Freelancers often have to pay this tax unless they also fall under the definition of a Free Employee according to German law.

Working Method And Payment

- Customer Relationship: Both freelancers and free employees can have multiple clients simultaneously, but free employees tend to have longer-term and specialized relationships, especially in regulated industries.

- Payment Models: Freelancers often work on a project-based basis and are paid per project or per hour. Free employees, on the other hand, can also have retainer contracts where they are paid by a client for a specified period of time.

Responsibility And Autonomy

- Autonomy: Both groups enjoy a high degree of autonomy and flexibility in their work. However, free employees, especially in regulated professions, often have stricter ethical or professional guidelines they must adhere to.

- Responsibility: Both freelancers and free employees are responsible for their own accounting, taxes, and other administrative tasks. The difference often lies in the complexity of the requirements, which can be higher for free employees due to professional regulations.

How To Become A Freelancer?

To become a freelancer, you must first develop expertise in your field. Build a portfolio of your best work to convince potential clients. Identify your target audience and niche to market your services effectively.

It’s important to take legal steps such as registering your business and addressing tax matters. Use freelancer intermediaries like ElevateX to acquire clients and build long-term relationships. Look for jobs on freelancer platforms or through personal contacts.

Having a solid financial strategy to effectively manage your income and expenses is crucial. Additionally, it’s essential to stay up-to-date with the latest developments in your field to remain competitive in a constantly changing environment.

With dedication, self-motivation, and perseverance, you can work successfully as a freelancer and achieve your professional goals.

Are you looking for freelancers?

How To Become A Free Employee?

Do you want to become a free employee? Here are the steps you can follow:

- Self-assessment: Consider if self-employment suits you and if you have the necessary skills and qualifications in your field.

- Develop a business idea: Define the services or products you want to offer and identify your target audience.

- Create a business plan: Plan your goals, target audiences, marketing strategies, and financial forecasts.

- Choose a legal form: Decide which business structure suits you best and learn about the legal requirements.

- Registration: Register your business with the relevant authorities and obtain the necessary permits.

- Taxes and accounting: Ensure compliance with all tax obligations and maintain accurate accounting records. A tax advisor can assist you with this.

- Financing: Plan how you will finance your business, whether through savings, loans, or investors.

- Marketing: Develop a marketing plan to attract customers and promote your business.

- Contracts: Enter into contracts with clients to define services and conditions.

- Insurance: Consider insurance to protect against liability risks or illness.

Adapt these steps to your specific situation and the requirements of your country and industry, and seek legal and financial advice early on to successfully start your career as a free employee.

Conclusion

In this blog post, we have highlighted the differences between freelancers and free employees. Freelancers are independent professionals who work on a project basis and enjoy high flexibility. They often specialize in specific areas and are responsible for their own accounting. Free employees, on the other hand, often practice “free professions,” have specific qualifications, and can work in diverse industries. They have longer-term client relationships and are exempt from trade tax. Both groups have autonomy but must meet different legal requirements. The choice between a freelancer and a free employee depends on individual skills, qualifications, and preferences. In any case, self-employment requires commitment, self-motivation, and sound financial planning.

The main difference lies in the legal classification and the associated tax benefits. Free employees are usually not subject to trade tax, while freelancers often are.

Free employees typically work in scientific, artistic, or advisory professions. These include doctors, engineers, lawyers, and many IT experts.

Freelancers are more flexible and can work in various industries but often have to pay trade tax. Free employees have tax benefits and higher social status but are often limited in their choice of projects.