Especially in the IT sector, but also in other project fields with creative demands, employees are not always employed on a salaried basis. For project-related work, the freelancer contract is the best option. On its basis, you are dealing with a contract for work or services, but you are not working as an employee. Especially for solo self-employed, the contract for freelancers offers maximum flexibility and regularly a lot of room for negotiation. However, there are some important aspects to consider so that you don’t get into trouble with social security. In this article, you will learn what you need to pay special attention to in the freelance contract sample.

What Is A Freelancer Contract?

In terms of its legal classification, the freelance contract is a contract for work or a service contract. You can find the main legal principles in the German Civil Code (BGB). Contracts for work and service contracts differ significantly. In a contract for work you owe a success, in a contract for services you provide services regularly according to time.

The contract for work can, for example, refer to the development of a certain software. You have not fulfilled the contract until the software has been completed. The client must accept the software for you to be entitled to remuneration.

In the case of a service contract, it does not depend on the occurrence of success. You perform your activities on a time basis, which is the basis for billing. Some contracts for freelancers contain elements of work and service contracts.

In summary: The freelancer contract forms the contractual basis for the activities of freelancers in the context of projects such as in the IT sector. Your contractual partner is not called the employer, but the client. You are the contractor.

How Does A Freelancer Contract Differ From A Normal Employment Contract?

The employment contract that employees conclude with their employer is also a service contract. However, special rules apply to it. With regard to the dependent employee, labor law is an employee protection law. The normal employment contract is based on two main obligations. The employer owes the wage, the employee owes his working time. In a dependent employment relationship, many other secondary obligations arise. Among other things, most dependent employment relationships are subject to social security contributions. Here, the employer is obliged to pay his share of social security contributions. He also pays the wage tax directly to the tax authorities. The employee is integrated into the organizational process of his employer. The employer provides working material and also the workplace.

The freelancer contract is different. The remuneration here does not consist of wages, but of a monetary payment, which the parties freely agree upon. For example, many freelancers are paid per hour. Likewise, in the case of a contract for work, the remuneration can be set as the total consideration for the work. No dependent employment relationship arises in this contractual relationship. For this reason, social insurance does not play a role, with a few exceptions, such as pension insurance for freelance lecturers. As a freelancer, you are responsible for your social security. In most cases you will also bring in your own work material. You are not integrated into the organizational process of the client, but determine yourself when, where and how you work.

Service Contract vs. Contract For Work

Contracts for work and service contracts differ significantly from the contract for freelancers.

Contract for work – You owe the client success in the contract for work. If we go back to the example with the software, you guarantee that the software works as described in the contract. You are liable for this. How you achieve success, whether you work yourself or involve additional employees, is your decision.

In the case of a contract for work, the client accepts the work. Acceptance is the prerequisite for the claim to remuneration to arise. With the acceptance, the client confirms that the work has been properly completed. If you have already agreed with the client on early payments prior to acceptance, these are considered advance payments that are credited against the remuneration claim arising upon acceptance. How much working time you spend on the creation of the work is irrelevant for the remuneration. You must make your own calculations in order to agree on an appropriate payment for the work.

The regulations for the contract for work can be found in § 630-650 BGB.

Service contract – here you provide services for the client. Many consulting contracts are service contracts. In this type of contract, you are not responsible for any success. How you perform the service is also up to you.

Service contracts are regulated in § 611-630 BGB.

Sample templates from the IHK

If you want to take a closer look at specific contract templates, you can find current templates on the websites of the Chambers of Industry and Commerce in Germany. Here we have linked three specific templates from the IHK Frankfurt am Main for you:

KEY POINTS

- The freelancer contract is a contract for work or a service contract.

- Contracts for work and service contracts differ significantly.

- In a contract for work you owe a success, in a contract for services you provide services regularly according to time.

- In the freelancer contract, three forms of remuneration are in the foreground. These are also combined under certain circumstances.

Freelancer Contract - What Should Be Included?

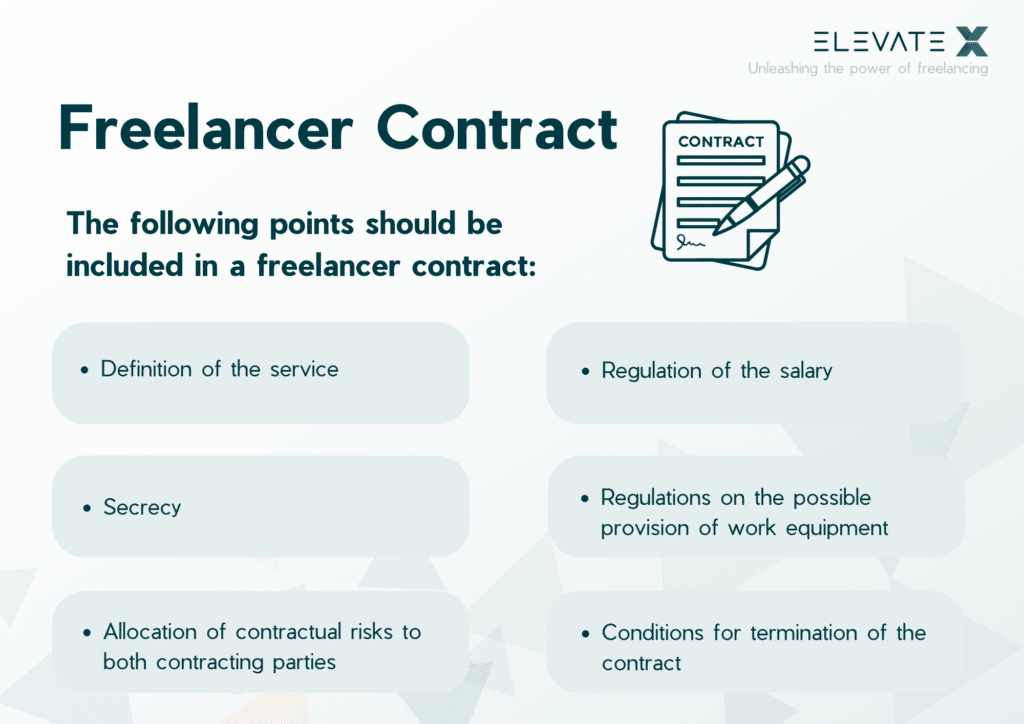

Each freelancer contract is an individual contract. Every freelancer contract has specific, project-related content. Nevertheless, there is a basic framework for all these contracts. A freelancer contract template necessarily includes the following points:

- Definition of the service (service description)

- Regulation of the remuneration

- Allocation of contractual risks to both contracting parties

- Possible fixed periods for the performance of the service

- Conditions for termination of the contract

- Regulations on the possible provision of work equipment (In some areas, the client must provide some work equipment for safety reasons).

- Confidentiality (In many contracts, information on techniques and other trade secrets are exchanged. It may be important to agree on confidentiality beyond the end of the contract).

In some contracts, agreements on competitive activity and copyright protection are key elements. In particular, they specify when and how which rights are transferred to the client. It also makes clear which rights remain with the contractor.

Particular attention should be paid to the definition of the service description. It must be clear here whether the contract is a contract for work or a service contract. Particularly in the IT sector, disputes about a freelance contract often arise due to an inadequate description of services. In case of doubt, the employer and employee should therefore take some time to define the service. The allocation of contractual risks (liability) must also be clearly and comprehensibly regulated. This is also a typical source of later legal disputes.

Avoid Bogus Self-employment In The Freelancer Contract

Dependent employment relationships are associated with a large number of secondary obligations, especially in the area of social insurance. For this reason, social insurance agencies keep an eye on whether freelancers are actually working as freelancers in individual cases. There are significant legal consequences associated with compulsory insurance status. In some cases, social insurance agencies assume bogus self-employment. In this case, the contract may make it appear that the employee is a freelancer, but in reality the social insurance agencies consider the employee to be a salaried employee.

What Does Bogus Self-employment Mean?

The term “bogus self-employment” is used to describe the situation in which a freelance activity is outwardly present, but the further circumstances and conditions of the cooperation establish a dependent employment relationship. Defined very briefly, bogus self-employment is another form of undeclared work. In this case, it is assumed that the client and contractor want to circumvent the social security obligations by drafting a contract with the freelancer contract. However, the parties are not always aware of this circumvention. Therefore, as a solo self-employed person, it is of great importance to know the criteria for the assumption of a bogus self-employment and to avoid it at all costs. Among other things, there is a risk of criminal consequences as well as additional payments of social security contributions in a considerable amount.

How To Avoid Bogus Self-employment In A Freelance Contract?

In the context of bogus self-employment, various aspects are repeatedly mentioned that can justify this. For example, working for a client over a longer period of time can be decisive. It is also said to be critical if the contractor works predominantly on the client’s premises. The social insurance agencies themselves pay particular attention to whether a freelancer works largely independently. This depends, for example, on the fact that the employee is not bound by instructions and is free to work at any place and at any time.

Whether or not a bogus self-employment exists is always a case-by-case decision. In some cases, only a pension insurance obligation may exist. In order to avoid the suspicion of bogus self-employment, the contracting parties should clearly point out these points in a freelance contract:

- The contractor renders his service independently.

- He is not integrated into the organizational process of the client.

- He decides for himself when, how and where he will work.

You should pay attention as a freelancer yourself to be active for several clients if possible. However, this criterion does not play a decisive role. Nevertheless, by working for several clients, you can provide another indication of your self-employment.

It is important that no elements appear in the contract that indicate an employee or an employee-like function. For example, the mention of a vacation entitlement may be a clear indication of an employee function in a dependent capacity. The boundaries are blurred in individual cases.

Due to the considerable consequences of assuming bogus self-employment, it is advisable to consult a social insurance agency or an expert when/before concluding the contract in case of doubt. If you adhere to the usual freelancer contract samples, you minimize the risk of assuming bogus self-employment. However, as mentioned above, freelance contracts are individual contracts. The aspect of bogus self-employment should never be completely lost sight of.

Looking for the right freelancer?

How Are Freelancers Paid?

The freelancer contract focuses on three forms of remuneration. These are also combined under certain circumstances.

Lump-sum payment or fixed price – in this case, all services are covered by a single contract.

Payment according to time and effort – payment is made according to working days or working hours.

Combinations as a mixed form – payment is made for 8-hour days, for example, without charging for additional work.

The contracting parties are free to determine the remuneration. Lump-sum remuneration can more often be better suited to reflect the remuneration in the contract for work. On the other hand, effort-based remuneration is the typical form of remuneration for service contracts.

Conclusion

The freelancer contract is the essential basis for the cooperation between contractors and clients. It is indispensable in many project areas, such as IT. Many individual arrangements are possible, since the freedom of contract is not restricted, unlike in the case of employee contracts. However, both parties should keep the issue of bogus self-employment in mind. The later assumption of a bogus self-employment with subsequent payment of social security contributions is an expensive matter.

It is the legal basis for the cooperation of a client with a freelance contractor. Unlike the employee contract in an employment relationship, the freelancer offers his services independently. He decides when, how and where he performs the agreed services for the client. The main obligations of the contracting parties in a freelance contract are service/work against remuneration.

In the contract for work the success is owed, in a contract for services the work performance is owed as a service. It is important to note that in a contract for work the remuneration arises only upon acceptance of the work. The contractor is liable for the success.

Among other things, the decisive factor is whether the freelancer works independently. He must not be part of the client’s sub-organizational process and must remain free in the provision of his services. The freedom refers mainly to the decision when, where and how he works. In the contract, all elements that normally only belong to employees, such as an agreement on vacation, must be avoided.