Are you considering starting your own business in the future and want to pursue a freelancing career? The ability to work as a freelancer is contingent on having the right credentials and is particularly related to the expertise and experience of the individual. In this blog post, we explain to you what taxes you will have to pay as a Freelancer.

Which Taxes Do I Have To Pay?

For freelancers, income tax and sales tax are particularly relevant.

Income Tax

Like every entrepreneur, freelancers also have to pay income tax. The amount of income tax depends on the amount of your income (minus your expenses). The tax burden increases progressively. This means: The higher your income, the higher the share of taxes you have to pay. Based on your annual income tax return, the tax office determines so-called installment payments, which you have to pay quarterly. If the annual tax return shows that you have paid too little or too much in advance, you will have to pay the difference in arrears or you will receive a refund or credit.

Sales Tax and Input Tax

Sales tax (also known as value-added tax) is levied on almost all products and services in Germany. As a rule, it is 19 %. For certain products (for example, food) and services (for example, translations), a reduced VAT rate of 7% applies. Of course, freelancers also have to pay this tax when they buy products or use services. The sales tax included in the invoices you pay is called input tax. The sales tax that you receive from your customers is simply called sales tax. This is a transitory item, which means that you pay it 1:1 to the tax office. This is done with the so-called advance return for sales tax.

Important: When keeping accounts and checking your liquidity based on your account balance, remember the sales tax that may not yet have been paid to the tax office. When calculating prices, always keep in mind the difference between net (without sales tax) and gross (without sales tax). It is customary to quote net prices when making price inquiries in the business sector.

Small Business Regulation

Freelancers, like all start-ups, can make use of the so-called small business regulation. This regulation exempts you from the obligation to charge sales tax on your services. The prerequisite for this is that your turnover in the year of foundation is less than 22,000 euros and in the following year does not exceed 50,000 euros. The small business regulation has some advantages, but also a big disadvantage.

The advantages are:

- Invoicing is less time-consuming.

- Your services are cheaper for the end customers.

- You do not have to make any advance sales tax returns to the tax office.

Disadvantage: You are not allowed to claim the sales tax you paid from other invoices as input tax. This means that it cannot have a tax-reducing effect.

Therefore, you should carefully consider whether or not to make use of the small business regulation. Especially because you are bound to a voluntary waiver of the small business regulation for five years. Only after these five years have elapsed you can apply for the small business regulation – as long as the requirements for this are met.

KEY POINTS

- Like every entrepreneur, freelancers also have to pay income tax. The amount of income tax depends on the amount of your income

- Freelancers also have to pay Sales tax when they buy products or use services.

- Freelancers are generally exempt from the trade tax obligation, because they do not have a trade

- There are various tax allowances from which you can also benefit as a freelancer.

Differences between Freelancers & Business

In §18 of the Income Tax Act, there is a catalog listing professions that count as freelance activities. These so-called catalog professions include

- Medical, dental and psychological personnel

- Alternative practitioner

- Architects

- Engineers

- Auditors, tax consultants

- Legal advisors

- Interpreters, translators

- Journalists, writers

- Actors

- Artists (musicians, painters, sculptors, designers)

However, in the text of the law there is still the addition “as well as similar professions”, which makes the assignment sometimes not quite simple. If your activity cannot be clearly assigned to a catalog profession, you can apply for it to be recognized as a freelance activity. However, you do not have a claim to it. The decision on this is always made by the tax office responsible for you.

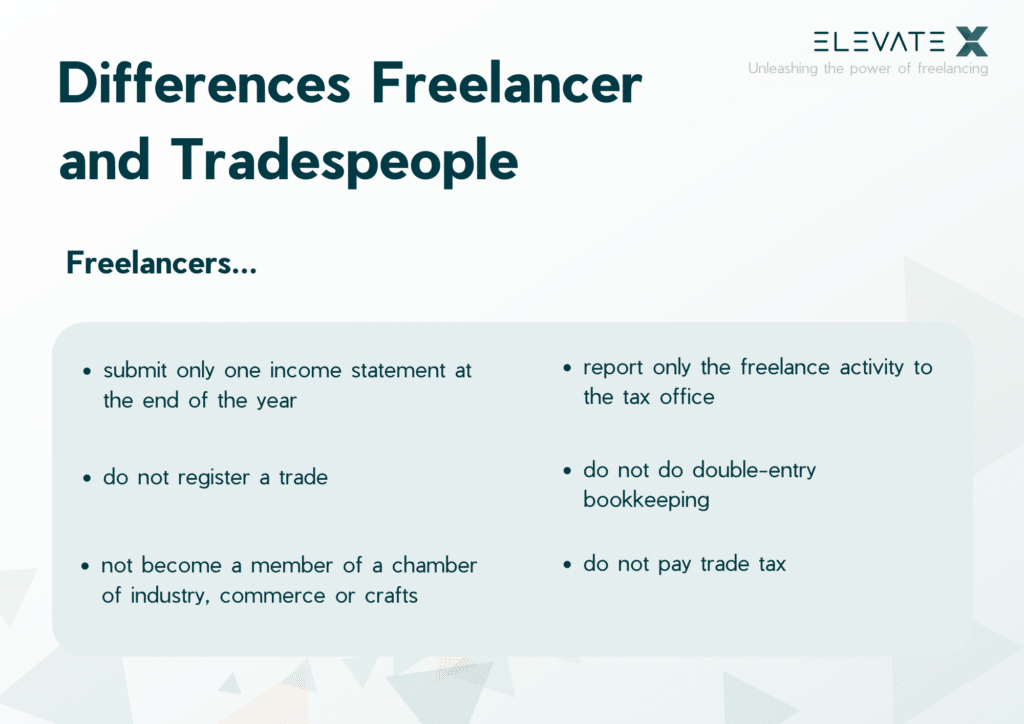

Under tax law, freelancers and tradespeople are always treated differently. In contrast to tradespeople, freelancers

- do not have to register a trade

- instead, they only have to report their freelance activity to the tax office, which issues a tax number

- they do not have to do double-entry bookkeeping

- do not prepare a balance sheet or a complex profit and loss account at the end of the calendar year, but only submit an income statement (EÜR)

- not become a member of a chamber of industry, commerce or handicraft (and pay fees for this)

- not pay a trade tax

No Trade Tax for Freelancers

Anyone who generates income from a business must pay a trade tax. This applies – irrespective of the industry or activity – to partnerships as well as to sole proprietors. Freelancers, however, are generally exempt from the trade tax obligation, because they do not have a trade (in the fiscal sense).

Note: In certain exceptional cases, freelancers may also be liable to trade tax. This is the case if a certain proportion of their income is derived from an activity that can be classified as a trade and not as a freelance activity. A typical example is a dentist (freelance) who, in addition to his practice activities, also sells dental care products (commercial).

What Tax Allowances Are There?

There are various tax allowances from which you can also benefit as a freelancer. We have summarized the most important ones for you here:

In Germany, income only has to be taxed above a certain amount. In this way, the state wants to ensure the subsistence level of the self-employed. Only when this minimum amount is exceeded, income taxes are due. The tax-free amount changes slightly every year. For the 2022 tax year, the basic tax-free amount for single persons is 10,347 euros, for 2023 it is 10,908 euros.

By the way: You don’t have to apply for the basic allowance separately. It is automatically taken into account by the tax office when calculating income tax.

There is also an allowance for sales tax. If you have made less than 22,000 euros in one year and have also made or expect to make less than 50,000 euros in sales in the following year, you can make use of the small business regulation. This exempts you from the obligation to pay sales tax.

Freelancers who are also commercially active (but only then!) are subject to trade tax. This becomes due as soon as you generate a profit of more than 24,500 euros.

If you have built up high reserves as a freelancer, you must pay tax on the interest from your capital assets. However, there is also an allowance for this tax. For single people it is 801 euros. Important: In order to be able to claim the saver’s allowance, you must submit a corresponding exemption order to your bank.

Are you a Freelancer?

Find jobs here.

Freelancer and Tax Return - What You Should Consider

Income Tax Return

If your income as a freelancer is below the basic tax-free amount, you do not have to pay income tax. However, you are still obliged to file an income tax return.

Important: Since 2011, freelancers (and tradespeople) have to file their tax returns electronically. You can get the necessary forms either via special tax programs or via the tax portal ELSTER. The last is provided free of charge by the tax authorities.

The income tax return includes:

- the covering sheet with general information (including name, address, date of birth, tax number)

- Annex S (for freelancers and other self-employed professions) with information on income and expenses

- Annex EÜR

The deadline for filing income tax returns is usually July 31 of the following year (by February 28 of the year after next if a tax advisor is used). However, due to the Corona pandemic, the deadlines have been pushed back. It is uncertain, though, how long this regulation will remain in effect.

As soon as your income exceeds the basic tax-free amount, the tax office will contact you very soon and determine an advance income tax payment. This is to be paid quarterly and is intended to protect self-employed persons from excessive payments at the end of the year.

Tip: To avoid any unpleasant surprises when you receive your tax assessment, you should definitely set aside a portion of your income for tax payments during the year.

There are certain deadlines for advance income tax payments by which the payment must be received by the responsible tax office. These are usually the 10th of the last month of each quarter, i.e.

- 10th of March

- 10th of June

- 10th of September

- 10th of December

You can either make the payment as a bank transfer or give the tax office a direct debit authorization. The last has the advantage that you do not miss a deadline.

Sales Tax Return

There are also some things to consider when it comes to sales tax: For example, how often you have to pay the collected sales tax to the tax office depends on the amount of your income or the annual income tax to be paid, as the following overview shows:

- more than 7,500 Euro income tax: monthly advance VAT return

- 1,000 Euro to 7,500 Euro income tax: quarterly advance VAT return

- less than 1,000 euros income tax: annual advance VAT return

The deadline is always on the 10th of the following month, quarter or year. In the case of a quarterly advance VAT return, you must therefore always submit it on April 10, July 10, October 10 and January 10.

There are two types of tax payment for sales tax: debit and actual. It determines which or when you have to pay the sales tax that you invoice to your customers to the tax office.

With debit taxation, you pay the VAT to the tax office as soon as you have invoiced it (regardless of when the customer has paid it). With actual taxation, you pay it only when the customer has paid the invoice (regardless of when you have issued the invoice).

The advantage of actual taxation is that you do not have to pay the VAT to the tax office in advance, which protects your liquidity. However, you may only make use of actual taxation if your total turnover in the previous year was less than 600,000 euros. If this condition is met, you can submit a corresponding application to the tax office.

Freelancers and Taxes: The Most Important Facts at a Glance

Freelancers must pay income tax – how much depends on the amount of their income. From an annual turnover of 22,000 euros, they are also obliged to collect and pay sales tax. As a freelancer, you do not have to pay trade tax if you do not carry out an activity that is considered a trade. Furthermore, you are not obliged to keep double-entry bookkeeping and – like any self-employed person – you can take advantage of various tax allowances. Regardless of the amount of your income, you have to file an income tax return and an annual VAT return, for which certain deadlines have to be met. Depending on how high your income is, you may have to make advance income tax payments and submit VAT returns more frequently (e.g. quarterly or monthly).

As a freelancer, you pay income tax – just like any self-employed person – if your income exceeds a certain amount. In addition, freelancers are required to charge sales tax on their services and pay it to the tax office, unless they fall under the small business regulation.

Although freelancers and tradespeople are both self-employed, their activities differ from each other: freelancers primarily perform teaching, educational, scientific, artistic and consulting or similar activities. However, the delimitation of activities is not always clear. Tradespeople have more administrative and tax obligations than freelancers (for example, business registration, accounting, business tax).

No, freelancers do not have to pay trade tax – provided that they are not simultaneously engaged in a commercial activity. In this case, they would also be obliged to pay trade tax, provided they exceed the tax-free amount of 24,500 euros.