Those looking for a business account as a freelancer or self-employed individual will come across numerous offers from branch banks and direct banks online. The variety of offers from banks is so diverse that it’s easy to lose track. The main question is whether freelancers actually need a separate business account and what advantages it can bring. So, what characterizes an business account for freelancers and what should you definitely consider when signing a contract?

Do Freelancers Need a Business Account?

The question of whether freelancers are obliged to have a business account can be answered with a clear no. Although it is not advisable, a freelancer can use their personal checking account as a business account. However, it is very sensible to open a separate account. A personal account has various debits running through it each month that essentially have no place in the business realm.

Easier Bookkeeping

If deposits and debits are mixed in a private and business account for freelancers, the overview is also lost. This will become clear to you at the latest when you have to do the accounting for your business. After all, the tax office wants to know which debits and deposits are private or business-related.

The Private Use of the Account is Not Always Possible for Business

Another reason that necessitates an account for freelancers is the bank. Not all banks allow the private and business use of a checking account. As soon as the bank or credit institution notices that business-related debits and incoming payments are being made on the private checking account, they can demand that you open a business account for freelancers. The bank can even terminate the account. You should keep in mind that switching bank accounts later on can be a major effort for you and your business.

A Business Account is Mandatory for Corporate Entities

There is a legal obligation to maintain a separate business account only if, as a freelancer, you have founded a stock corporation, a partnership limited by shares, an entrepreneurial company, or a limited liability company. Corporations are considered legal entities in Germany and are not allowed to process their business income, expenses, and payments through a private checking account. Another reason why an account for freelancers is mandated for corporations is due to tax considerations.

KEY POINTS

- A separate business account is recommended for freelancers to clearly separate business and personal finances.

- When choosing the right business account, costs, digital connections, and additional functions are crucial.

- The offers of different banks should be carefully compared, as services and fee structures for business accounts can vary significantly.

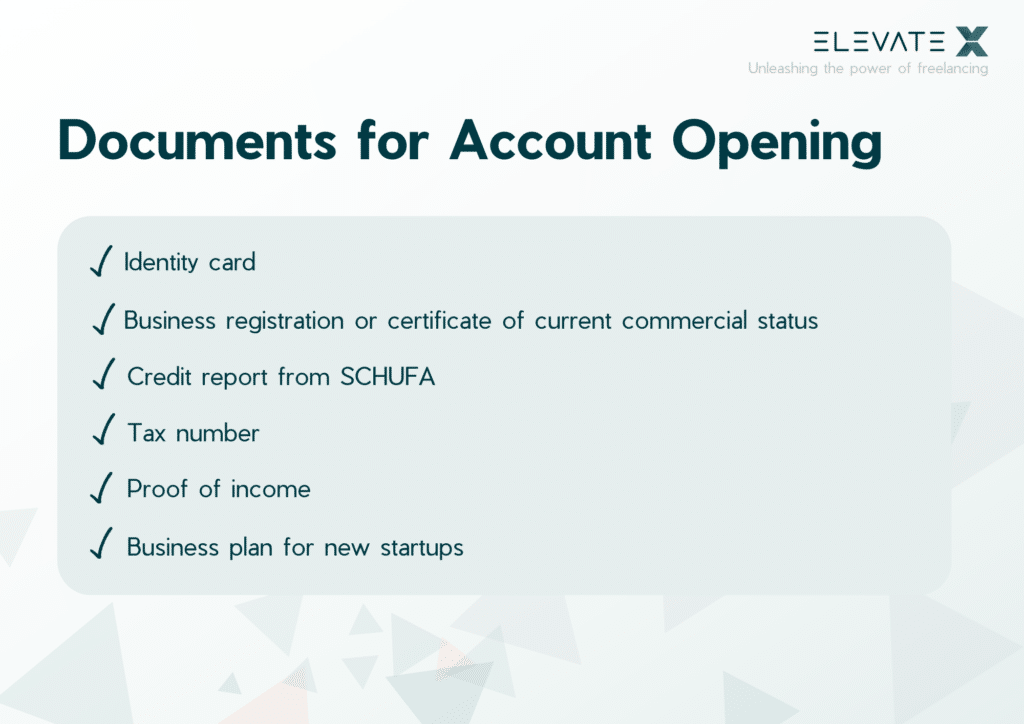

What Documents Are Required for Opening an Account?

Once the decision for an account model and a bank has been made, nothing should stand in the way of opening the account. To open a business account, the freelancer must present various documents at the bank or credit institution.

- Proof of identity. This includes an identity card or passport

- Business registration or certificate of current commercial status

- Credit report from SCHUFA

- Tax number

- Proof of income and/or last bank statements

- Business plan for a new startup

It is advisable to seek clarification from your bank or credit institution regarding the necessary documents prior to opening an account. Demonstrating sufficient preparation during this process can significantly enhance the perception of your company’s professionalism.

How Can You Digitalize Your Business Account for Freelancers?

Digitalization plays a very important role in today’s world. In the business and financial sectors, it simplifies and especially speeds up many processes. Your life as an entrepreneur becomes much easier if your account for freelancers is linked to software. With some account models from various banks and credit institutions, the software for digitalization is included. With other business accounts, you need to purchase the software separately. This refers to modern accounting software with which you can also create and send invoices, for example. After linking it with the account for freelancers, you can see which items are still open or have already been paid. These functions are particularly helpful if you run an online store.

Modern Software Supports Account Management and Bookkeeping

With modern software, you also have the option to create your income-surplus calculation or the profit-and-loss statement. Even transferring data to a program like Datev or directly to your tax consultant is now possible. The exact functions depend on the type of software. Since not every account supports every type of software, you should get information from the bank before opening your business account.

Bring your freelancing game to the next level!

Business Accounts for Freelancers - An Overview

When choosing a bank or service provider, many different aspects need to be considered. Does the business account for freelancers offer innovative additional features and ease the often tedious office work? Are functions like accounting included, or is special software required? The following providers are recommended:

Qonto

Qonto is a good business account for freelancers and small businesses. The Starter account has a low basic fee of only 9 euros and allows for 100 free transactions. A disadvantage is that you cannot deposit cash.

Advantages

- Digital account opening: Quick and easy with immediate access and a German IBAN.

- Accounting facilitation: Financial functions integrated into online banking and data export possible.

- Flexible termination: Business account can be cancelled at any time without fees.

- Customer service: Accessibility by email and phone for support and advice.

Disadvantages

- Costly: No free account offer compared to some competitors.

- Transaction costs: SEPA transfer fees beyond the included quota.

- Cash withdrawals: Fees for withdrawals beyond the free limit.

- No cash deposits: Cash cannot be directly deposited into the business account.

- No direct debits: Customers must use alternative services for direct debits.

Kontist

Kontist’s business account is permanently free if you have a monthly turnover of at least 300 euros. The Free account allows for 10 free transactions per month. It is also not possible to deposit cash with this account.

Advantages

- Free account management: No monthly fees with over 300 transactions per month.

- Quick account opening: Fast and straightforward account opening via a mobile app.

- No SCHUFA query: Account opening is possible even with a negative SCHUFA score.

- Personal support: Live chat, email, and phone hotline for direct assistance.

- Kontist Duo for optimal financial management: Invoice creation, document archiving, and automatic categorization of bookings.

Disadvantages

- Account not consistently free: Restrictions on free account management if the minimum turnover is not met.

- Transaction fees: Fees incurred after the first 10 free transactions per month.

- Additional costs for currency conversions and cash withdrawals.

- No cash deposits or check cashing: Lacking physical banking functionalities.

- Limited payment services: Missing EC card and no support for Giropay or direct debit procedures.

DKB

The DKB business account costs 15 euros per month, and each booking is charged at 0.08 cents. However, cash withdrawals and payments are free of charge.

Advantages

- Digital account management: Fast and completely online account opening process.

- Free cash withdrawals: Possible across Europe at around 50,000 ATMs.

- Financial management: Free bookings with or without a voucher and free check deposits by mail.

- Cash deposits: Possible via ‘Cash in Shop’ at 12,000 participating stores.

- Consulting: 24/7 available professional customer support, especially for freelancers.

Disadvantages

- Account management fee: Introduction of a monthly fee of 15 euros.

- Additional costs: Various fees for different banking services.

- Personal consulting: Only available by telephone, no option for face-to-face conversations.

- Cash deposits: Free deposits are limited; fees apply at ‘Cash in Shop’ and other banks.

N26

N26 offers the Business Standard account for self-employed individuals and freelancers. With N26, online banking is available without account management fees, minimum balances, or fees for cash withdrawals. All incurred bookings are also free. Cash deposits are possible at so-called CASH26 partner locations.

Advantages

- Free-of-Charge: No conditions for the free-of-charge status of the account.

- Free international payments: No foreign currency fee with the Mastercard.

- Easy account opening: Low creditworthiness requirements and SCHUFA report.

- Free cash withdrawals: Three times per month in Germany with the Mastercard.

- Cash26 network: Free cash withdrawals and deposits (with a fee) at partner retailers.

Disadvantages

- No branch network: No personal contacts or branches for direct banking transactions.

- Custody fee: 0.5% fee per year on deposits over 50,000 euros.

- Fees after free limit: Costs after three free cash withdrawals per month.

- Debit card instead of credit card: No credit limit as with a real credit card.

FYRST

The FYRST BASE business account is suitable for freelancers looking for a comprehensive overall package. With FYRST, there are no account management fees, and up to 50 bookings per month are free. Cash deposits are possible at over 7,000 locations in Germany, and a low-cost accounting solution is offered.

Advantages

- German IBAN and Postbank ID: Integrated services of Deutsche Bank AG.

- Free account management: Including professional advice by email or phone.

- Extensive cash services: Free withdrawals at Cash Group and Shell gas stations.

- Accounting software connectivity: sevDesk integration for efficient accounting.

- Optimized tax consultant communication: Easy data transfer and payroll accounting solutions.

Disadvantages

- The FYRST Card is a debit card; a credit card involves additional costs.

- Costs for additional services and booking posts outside the account model.

- Non-voucher booking posts are charged after the free items.

- Additional fees for international transfers and payments outside the EU.

The offerings of the banks differ in scope. For an account for freelancers, the price-performance ratio plays a very important role. Kontist and N26 offer the business account for freelancers for free. All accounts either already include additional functions or are compatible with corresponding software. Each service provider offers its customers either a debit card or both a debit and credit card for cashless payments.

What to Consider When Choosing a Business Account?

Of course, as with all considerations, cost is at the forefront. A business account for freelancers can cost between 0 and 100 euros per month. The variable costs for transfers and other transactions also vary greatly. Therefore, you should not select your account for freelancers based solely on the standardized price list. It is advisable to play through different scenarios. For example, you should consider how many bookings occur monthly, how often the credit card is used, and how many cash transactions are made.

An Overdraft Facility is Advantageous

Before you open an account for freelancers, you should also think about the future. There can be financial bottlenecks during the business year. It is therefore important to choose a bank or credit institution that grants you an overdraft facility for these times. If you do not have a credit line, you would have to open an additional account. Conversely, an additional account for the credit line would then also mean additional costs.

The Legal Form Can Be Important When Opening an Account

Not all banks offer a business account for freelancers that accept all legal forms. If you change the legal form at a later stage, this can also lead to a change of the business account. You should therefore make sure that you can easily switch from a sole proprietorship to a GbR, UG, GmbH, or AG later on. However, changing banks also has other consequences for the business account of freelancers. You must inform all customers, traders, financial authorities, health insurance companies, and service providers that your bank details have changed.

Conclusion

Even if it is not legally required, freelancers should open a separate business account. The business account for freelancers should offer good value for money and be easy to digitize. It is advisable to compare different banks, credit institutions, and financial service providers before opening a business account.

A freelancer does not fundamentally need a separate business account, depending on the legal form. However, it is advisable to maintain a business account. Those who have founded a stock corporation, a partnership limited by shares, an entrepreneurial company, or a limited liability company as freelancers must have a business account.

There are numerous providers that offer the opening of a business account for freelancers – each offer includes individual conditions and features. Examples are Qonto, Kontist, DKB, N26, or FYRST.

A business account for freelancers should always have a good price-performance ratio. It is important nowadays that the account is compatible with software. This makes the tedious office work, which also occurs for freelancers, easier to handle.