According to Statista (as of October 2023) approximately 1.47 million people worked in a freelance profession in Germany in 2022. This number has been continuously increasing since 1992. Some self-employed individuals are also freelancers. These are either tradespeople or freelancers who run their business without any employees. In 2022, the Federal Statistical Office reported that 3.8% of all employed individuals were self-employed, without additional employees. For these professionals, accounting software may be essential. While freelancers do not require a business registration, they still have to submit an annual statement. But what is the purpose of accounting software, and who benefits from it? This guide provides information on popular accounting software for Freelancers and addresses basic questions.

What Is the Purpose of Accounting Software for Freelancers?

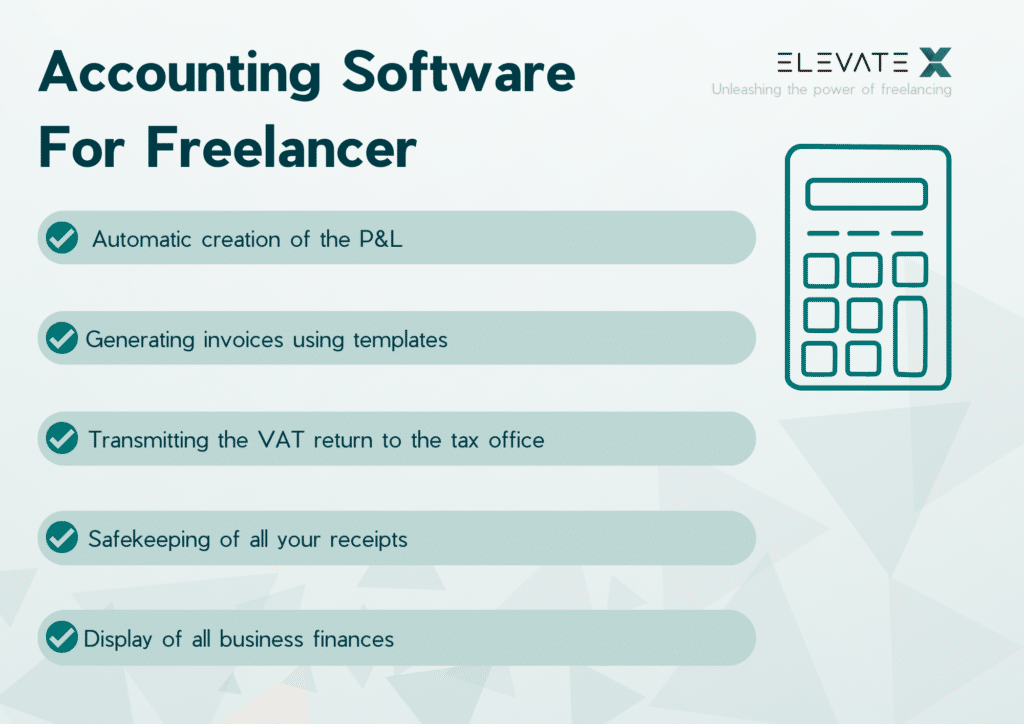

For the self-employed, especially many solo self-employed, accounting software doesn’t have to be as extensive as it is for large companies. Simple bookkeeping often suffices. Profit determination is carried out using the profit and loss statement (P&L). This serves as a basis for the tax office to determine taxes for freelance activities. Correct recording of income and expenses is essential. You generate this income from your contracts. You can obtain a client contract in various ways: One way to gain more visibility is by registering on freelancer platforms. Accounting software for freelancers can be helpful for bookkeeping. The programs record the fees and expenses and determine the data required for the tax office. Additionally, the software assists freelancers in the following tasks:

- Automatic creation of the P&L.

- Generating invoices using templates.

- Transmitting the VAT return to the tax office.

- Safekeeping of all your receipts.

- Display of all business finances.

For freelancers’ accounting, it is also essential to archive all receipts. Even if there is no obligation for double-entry bookkeeping, it is crucial to carry it out correctly.

KEY POINTS

- For freelancers, using accounting software can be crucial to ensure precise and efficient financial management while also saving valuable working hours.

- With features like support for profit and loss accounting, automated invoicing, and simplified VAT pre-registrations, these tools can not only increase accuracy but also reduce potential errors.

Various accounting applications are available on the market for freelancers. These include, for example, sevDesk, lexoffice, and orgaMax.

When Is Accounting Software Useful for Freelancers?

Accounting software is beneficial for anyone who handles many contracts and practices a freelance profession full-time. But even those who only freelance part-time benefit from this software. To keep track, it’s essential to keep all receipts in a safe place. In the age of digitization, a digital application is suitable for this purpose. This combines all essential functions and offers service solutions for freelancers‘ accounting from a single source.

What Should Accounting Software for Freelancers Include?

The software should meet all essential requirements needed to create a P&L. Additionally, the accounting software for freelancers should combine other essential functions that make your daily work easier, including:

- Online banking option

- CRM creation capability

- Interface for VAT registration to the tax office

- A digital cash register and document management

- Invoice creation with appropriate templates

- Management of outstanding items and payment transactions between customers and suppliers

- An ELSTER interface and tax consultant access

- Support or customer service in case of problems

Are You a Freelancer? Join Us Now!

Three Accounting Software Programs Suitable for Freelancers

sevDesk

Described by the software itself as “Germany’s most popular accounting software”. This assessment is based on customer reviews from various rating portals. Indeed, the cloud solution impresses with its intuitive usability. It is suitable for both self-employed individuals and limited liability companies (GmbH) and entrepreneurial companies (UG). The program follows the principles for the proper management and storage of books, records, and documents in electronic form (GoBD). It is possible test sevDesk for 14 days. The accounting software for freelancers costs €17.90 per month if you opt for a 24-month term. There are also offers for 12 months or one month.

The program offers a wide range of functions, including:

- Writing invoices

- Creating offers

- Payment reminders and credits

- Custom design of documents

- Receipt capture in the app

- Recurring invoices

- Linking with online banking

- VAT registration

- Automatic P&L

- Cashbook management

- Customer support

Freelancer bookkeeping significantly differs from a company’s double-entry bookkeeping. sevDesk is suitable for both entrepreneurs and freelancers.

The advantage for small businesses is that the software provides everything freelancers need to create a P&L.

A disadvantage of the application is that the program is designed for only three different users.

lexoffice

lexoffice is another cloud-based software for accounting tailored for freelancers. This program is also suitable for small businesses and limited liability companies. The software manufacturer advertises about having received numerous awards for its accounting software since 2012. Various magazines have crowned lexoffice as the test winner. The software adheres to the principles of proper management and storage of books, records, and documents in electronic form (GoBD). This application also stands out for its user-friendliness. Like sevDesk, lexoffice is suitable for various sectors.

The software offers a 30-day free trial. To access its full range of features, you’d need the XL version. This is available for €14.95 per month plus VAT. The lexoffice XL accounting software provides a broad range of functions, including:

- Invoicing

- Quotation writing

- Mobile work capabilities via the app

- VAT registration

- Online banking

- Cashbook

- Integration with online shops

- Profit and loss as well as EÜR creation (in the L and XL versions)

- Customer support

One drawback of the software is that as a freelancer, only the L or XL version would be appropriate for you. These options allow you to create a profit and loss statement but they come at a higher monthly price.

However, the test winner offers you several advantages, including user-friendliness and multiple user accesses. Another benefit is the option to add the “Wages & Salaries” feature. This provides you with additional functions, for instance, for recording employee data.

orgaMAX

This accounting software, suitable for freelancers and also applicable for companies, is the orgaMAX accounting variant. This software can be accessed via an app or online. You can test orgaMAX accounting for free for up to 14 days. After the trial, the cost for the S package is 8.00 Euros per month with annual billing, or 10.00 Euros per month with monthly billing. A minimum contract term of 12 months applies. Currently, the first six months are even free for new customers (as of March 2024) with annual billing for the packages S, M and L. orgaMAX S is designed for an annual turnover of up to 22,000 Euros, and orgaMAX M and L are unlimited in the annual turnover. The manufacturer, deltra, advertises it as an all-in-one solution for managing your entire company on a single platform. The available features include:

- Free support (via email, phone, or live chat)

- Orders and delivery notes

- Dunning system

- Smart document recognition

- Document management

- Online banking

- Shop integration

- GoBD-Optimization

There are different versions of the program, including a bespoke solution (SELECT – The Custom Solution). Apart from the accounting software for freelancers and the custom solution, orgaMAX offers further applications. This includes the BASIC program, a simple billing program.

The advantages of orgaMAX are evident: the accounting program for freelancers is accessible from anywhere via a browser or app. The required servers are located in a German data center. If you do need more functions, these can be booked on top. In addition to these extensions, from the BUSINESS package onwards, additional users can also be added. A unique selling point that orgaMAX offers is the ability to manage multiple companies separately within one account.

The disadvantages of the software are evident in the area of interfaces. For example, there is no connection to ELSTER.

Papierkram

Papierkram is a comprehensive solution for financial accounting targeting freelancers, small and medium-sized businesses. It offers features like invoicing, quotation creation, profit and loss reporting, VAT declarations, project time tracking, and a digital document archive. Accessible on PC, tablet, and smartphone, Papierkram offers flexibility. Its features include:

- Creating quotations and invoices

- Time tracking and project management

- Clear reports and business figures

- Customizable document templates

- Integrated CRM system

- Automatic generation of VAT declarations and profit and loss reports

Papierkram offers a 10-year data guarantee, even with a downgrade to the free version. It has received multiple awards and is GoBD-certified.

An advantage is the security offered by hosting and operating in Germany.

However, a potential downside could be the limitation of certain features in the free version.

Lexware

Lexware, established in 1989, is one of the most popular accounting software companies in Germany, catering to entrepreneurs, freelancers, and small to medium-sized businesses. With a 30-day free trial period, users can familiarize themselves with the software, which is available from €19.95/month thereafter. Lexoffice, particularly advantageous for freelancers, offers a wide range of accounting tools, direct interfaces to ELSTER for easy tax and VAT declarations, and support for annual tax returns.

- Invoice creation and management

- ELSTER integration

- Income and VAT declarations

- Automatic tax and VAT calculation

- Automatic invoice dispatch

- Web and mobile app

- GoBD and GDPR compliant

- Cashflow tracker and report generator

- Integrated online banking

- PayPal integration

- DATEV interface

Lexware is praised for its comprehensive and powerful accounting tools, ideal for German-speaking freelancers and small businesses.

However, the software is not available in English and has a somewhat outdated user interface. Mac users should note that Lexware is currently only available on Windows.

User reviews are mixed, with an average rating of 3/5 on TrustPilot, Appstore & GooglePlay, particularly criticizing the user interface and customer service.

FastBill

FastBill focuses on solopreneurs and offers a simple solution for invoicing and receipt management. The software facilitates tracking payments, correctly reporting taxes, and timely bill payments, enabling quick and professional handling of accounting. FastBill’s pricing plans are tiered according to functionality: “Solo” for €10 monthly (€9 yearly), “Plus” for €15 monthly (€14 yearly), and “Pro” for €30 monthly (€27 yearly).

- Professional invoice creation and dispatch

- Dunning process with customizable payment reminders and levels

- Receipt capture and categorization

- Customer management

- Banking with payment reconciliation

- Accounting with tax advisor access

- VAT declaration and financial reporting

- Project time tracking

- Over 30 partner integrations, including CRM or liquidity software

- API and Zapier app for integration with own tools

- Comprehensive reporting and analysis functions

The pricing plans of FastBill are tiered according to the scope of features: “Solo” for 10 euros monthly (9 euros with annual payment), “Plus” for 15 euros monthly (14 euros annually), and “Pro” for 30 euros monthly (27 euros annually). “Solo” offers basic functions such as invoicing and receipt management, “Plus” extends this with more comprehensive document management, and “Pro” adds additional automations and team functions.

easybill

easybill is a cloud-based invoicing and accounting software particularly suitable for freelancers and small businesses. It allows users to easily and efficiently create and manage professional invoices, quotes, and credit notes. The software offers a variety of features specifically tailored to the needs of freelancers. With prices starting at 9.95 euros per month for the basic package, easybill offers various subscription plans that vary based on the range of functions and the number of documents to be created.

Main features:

- Automated invoicing and dunning

- Integrated customer and item management

- Interface to online shops and merchandise management systems

- VAT advance return and profit-and-loss statement export

- DATEV export for tax advisors

- Customizable document templates

easybill provides a user-friendly interface that makes creating and managing invoices and financial documents easier. The integration with various online shop systems and the ability to export data for tax advisors make it an efficient solution for freelancers.

The cost for the software might be relatively high for some freelancers, especially those with lower document volumes. Additionally, there are limitations on the number of documents in the cheaper tariffs.

BuchhaltungsButler

BuchhaltungsButler is an innovative accounting software developed specifically for freelancers, small and medium-sized businesses. The software automates many accounting processes and offers an intuitive user interface. The pricing structure is flexible, starting at 19.00 euros per month for the basic package, which already includes a variety of functions. For more extensive needs, higher-value packages are available, offering additional features and larger contingents of booking transactions.

Features include:

- Automatic accounting and booking of receipts

- Integrated dunning process and payment reconciliation

- DATEV interface for tax advisors

- Comprehensive receipt management and digital archive

- Detailed evaluations and financial reports

- VAT advance return directly from the software

BuchhaltungsButler stands out for its high level of automation and user-friendliness, enabling time savings and increased efficiency. The software is GoBD-compliant and offers secure data storage in Germany.

A potential downside might be the training time required to understand all functions, as well as the cost of more comprehensive packages, which may be less suitable for smaller companies or freelancers with low transaction volumes.

Accountable

Accountable is a comprehensive accounting software ideal for freelancers and small businesses. It offers a user-friendly platform that simplifies financial management. Accountable is particularly known for its mobile app, which allows creating invoices and managing finances on the go. Prices start at 0 euros for the basic plan, which offers fundamental functions. For advanced features such as automatic tax reporting and personal tax advisor, there are premium plans that cost more.

Features include:

- Easy invoice creation and management

- Automated tax calculation and advice

- Integration of bank accounts for real-time financial overview

- Digital receipt management

- Personal tax advisor in the premium plan

- Interfaces to other accounting systems

Accountable offers the advantage of a comprehensive, mobile accounting solution, particularly suitable for freelancers who are often on the move. The app simplifies financial management through intuitive operation and automated processes.

A disadvantage might be the limited functionality of the free basic plan, and the need to switch to paid plans for more comprehensive services.

MeinTagwerk

MeinTagwerk is a specialized accounting and project management software mainly aimed at freelancers, creatives, and small businesses. It offers a unique combination of time management, invoicing, and customer management. MeinTagwerk stands out for its focus on project management and the needs of creatives. Pricing is transparent and starts at 8 euros per month for the basic tariff, which already includes a variety of useful functions. Higher-value tariffs offer additional features and greater flexibility.

Features include:

- Intuitive project and time management

- Automatic invoicing based on project times

- Detailed customer and order management

- Customizable invoice and quote templates

- Real-time overview of business figures and utilization

- Export functions for tax advisors and tax offices

The strength of MeinTagwerk lies in its ability to combine project management with accounting functions, providing a holistic view of projects and finances. This is particularly advantageous for freelancers and creatives who need to closely link their projects and finances.

A possible downside could be that it is less suitable for larger companies requiring more extensive accounting functions.

Billomat

Billomat is a flexible and user-friendly accounting software designed for freelancers, small business owners, and medium-sized companies. The software enables quick and easy creation of invoices, quotes, and reminders. Billomat offers various subscription plans differing in functionality and price. The starter package begins at 7.99 euros per month and includes basic features, while more comprehensive packages provide advanced features for larger companies.

- Easy creation and management of invoices and quotes

- Automated dunning and payment monitoring

- Interface with online shops and other tools

- VAT advance returns directly from the software

- Customizable document templates

- Cloud-based data management for mobile access

Billomat is distinguished by its ease of use and flexibility, allowing users to manage their accounting efficiently and effectively. The cloud-based platform ensures flexibility and accessibility, which is particularly advantageous for freelancers and small businesses.

A potential downside might be the limited features of the basic package, which may lead users to opt for more expensive packages to obtain all the necessary features.

SumUp

SumUp is an accounting software particularly suited for freelancers, small business owners, and startups. The software offers an intuitive user interface, enabling users to quickly and easily create invoices, quotes, and financial reports. SumUp emphasizes user-friendliness and offers various tariff plans, starting at 4 euros per month for the basic plan. Higher-value plans include advanced features like automated accounting and multi-currency capabilities.

- Fast and easy invoice creation

- Automated dunning and surplus income reporting

- Integration with bank accounts for real-time financial overview

- Multilingual invoices and quotes

- Access to financial reports and VAT advance returns

- Cloud-based platform for mobile access

SumUp is particularly known for its simple operation and quick setup, making it ideal for freelancers and small businesses without extensive accounting experience. Its cloud-based nature allows users to access their data from anywhere.

A disadvantage might be the limitation on certain features in the cheaper tariff plans, meaning users need to upgrade to more expensive plans for more comprehensive accounting needs.

here are various accounting applications available for freelancers in the market, including:

- lexoffice

- orgaMAX

- sevDesk

- Papierkram

- Lexware

- easybill

- Accountable

- MeinTagwerk

- Billomat

- SumUp

Other well-known applications suitable for freelancers are BuchhaltungsButler, FastBill, and WISO MeinBüro.

The prices for accounting applications vary greatly. The sevDesk software starts at a monthly price of €17.90. The most expensive model is the XL version of lexoffice, even though there’s a current discount for new customers. The regular price is actually €29.90 per month.

Robust accounting software for freelancers meets all essential requirements: it manages and archives receipts, enables invoicing, possesses external interfaces, for instance, to ELSTER. The application can also produce an profit and loss statement (P&L) for the tax office.