Bringing specialists into the company in a targeted manner, covering order peaks, compensating for absences due to illness: There are many occasions that bring free employees and companies together. We explain the legal differences, the advantages for both sides and possible pitfalls.

Free Employees: What Makes Them Tick

Free Employees who are booked for specific assignments are a valuable resource. Their special skills and flexibility complement a company’s permanent employees. However, they differ from these permanent employees in essential characteristics under labor law. Free employees are not subject to the social law provisions for employees, but must take care of their health insurance or pension themselves. Likewise, as a free employee, you are responsible for paying the taxes on your income yourself.

KEY POINTS

- Free employees are independent workers according to labor law.

- They are characterized by their special skills and flexibility.

- They differ significantly from permanent employees in terms of labor law.

- Must pay their own taxes.

Differences: Freelance Employee, Freelancer, Self-Employed Worker?

The difference between a free employee and a freelance employee is only linguistic. Both refer to and mean the same thing, namely a temporary employee who works for his or her own account. It rather depends on the industry which designation is chosen. In the field of media, media design and advertising, the term free employee is predominantly used. In the case of lawyers, doctors or teaching jobs, the term freelance employee still prevails.

The term self-employed worker, on the other hand, is a fiscal term. While free employees are self-employed, not every self-employed person is a self-employed worker, even though the terms are often mixed in common usage. Who is considered a self-employed worker is clearly defined in tax law. Section 18 EstG regulates this precisely. The regulation is clear when it comes to professional groups such as doctors, midwives and other medical professions, lawyers and tax consultants, or architects and engineers. They are clearly free employees and are not subject to trade tax.

However, there are borderline areas, such as IT or advertising, where the individual tax offices assign self-employed persons to tradespeople instead of free employees. Explained by example: IT specialists who only work as lecturers for several institutions can refer to a free employee status. If, on the other hand, an IT specialist advises companies on how they can individually set up their systems, security measures, etc., he is recorded as a trader. He must register this trade with the relevant office.

- Freelance employee: not permanently employed, works on own account

- Free employee: identical with freelance employee

- Self-employed worker: tax-law term for certain professions, e.g. doctors and lawyers

- Tradesmen: Self-employed persons who do not fall under freelancers.

Free Employee: The Basis of Their Activity

A key differentiator from permanent employees is that free employees are not integrated into the company. They do not receive an employment contract; their cooperation is governed by a service or work contract. Their activities are not subject to any labor law provisions. They are neither bound by nor protected by labor law.

Temporary Assignment: Free Employee

Whether a freelance employee comes to the company for a certain duration or for a specific project is specified in the contract for work or service. In the area of IT, this would be, for example, the installation of equipment in a third-party company or the development of software at the contractual partner, for which free employees are booked.

The activity in the company ends automatically with the fulfillment of the contract, no notice of termination is given. However, it is possible to withdraw from the contract for important reasons. The requirements that must be met for this depend on the individually agreed contract terms. Newcomers who want to work as free employees for the first time, as well as companies that are also new to the idea, are therefore well advised to draft or review a contract for work or services with the help of competent support.

Between Freelancing and Pseudo-Self-Employment: Recognizing the Boundary Lines

Here, as with the classification as a free employee, the boundaries may not be exact, but rather fluid, despite legal regulations. For you as a freelancer, it is just as important to know when you can lose your status as a free employee as it is for companies. Both sides run the risk of demands from the legislator or even penalties in the worst case. If a pesudo-self-employment is established, social contributions must be paid in arrears. Companies can only pass on these demands to free employees to a limited extent. The free employee himself often gets into serious financial difficulties due to the not exactly small additional payments.

However, if you know the criteria that the authorities apply to free employees and know when they are talking about bogus self-employment, you can avoid the pitfalls. The German Pension Insurance defines pseudo self-employment as follows: “Pseudo-self-employed persons are persons who formally appear as self-employed (contractors), but are in fact dependent employees within the meaning of § 7 para. 1 SGB IV. The client must check – as every employer must do with his employees – whether a contractor is employed by him as a dependent employee or is working for him as a self-employed person.”

Pseudo-self-employment: free employees who work permanently for a company on a fixed basis.

In practice, this is determined by the following characteristics:

Freelance Work for a Limited Number of Companies

Free employees who can only win orders from a single company fall particularly quickly into bogus self-employment. The authorities usually see this as a permanent employer. Exceptions can be justified if you as a free employee can prove that you are in the process of building up your business. In this case, you have to prove that you are trying to get more orders from other companies in parallel to your work for one company. But even orders from two or three companies can lead you to the classification as a bogus self-employed person, because other criteria also count.

Reasonable Fee for Free Employees

Many IT companies have failed with its free employees because they saved on the hourly rate. The tax office takes the position that an amount must be paid per hour worked that is at least twice as high as the normal hourly rate for employees in this field. The reasoning behind this is logical. Those who work on their own account must provide for their own health insurance and pension. The amounts are high because as a free employee, you are both employee and employer, so to speak. Private insurers charge a rate that is roughly similar to the added employee and employer contributions of normal employees. Taxes must also be paid out of the hourly rate. The initial tax rate is 14%, and at least this amount must be included in the fee.

Permanent or Regular Work Contracts for Free Employees

Free employees and companies alike are accused of bogus self-employment when contracts with very long terms are concluded. In this case, the authorities assume that the only purpose is to avoid paying social security contributions. The authorities also become suspicious in the case of regularly recurring contracts. This is particularly the case if the contracts are not for clearly defined projects but for general cooperation. Regulated working hours can also be an indication of pseudo-self-employment, but this is decided on a case-by-case basis. Working as a “permanent free employee” can also lead freelancers to the suspicion of pseudo self-employment. This is the rule in many industries, such as the media. Nevertheless, every contract should be checked carefully for content and effects so that free employees work and bogus self-employment remain clearly separated.

Written Work Instructions From the Company

The free employee is characterized by the fact that he works not only on his own account, but independently within the framework of the contract for work. The employing company has no right to give work instructions to the free employee. On the other hand, the involvement of the free employee in operational decisions can also be a source of danger. If the free employee is not the project manager according to the contract, but only works temporarily for a certain number of hours, operational decisions such as the use of capital, sources of supply or the deployment of machines and permanent staff do not usually fall within the free employees remit.

Searching for a free employee?

We are here to help you.

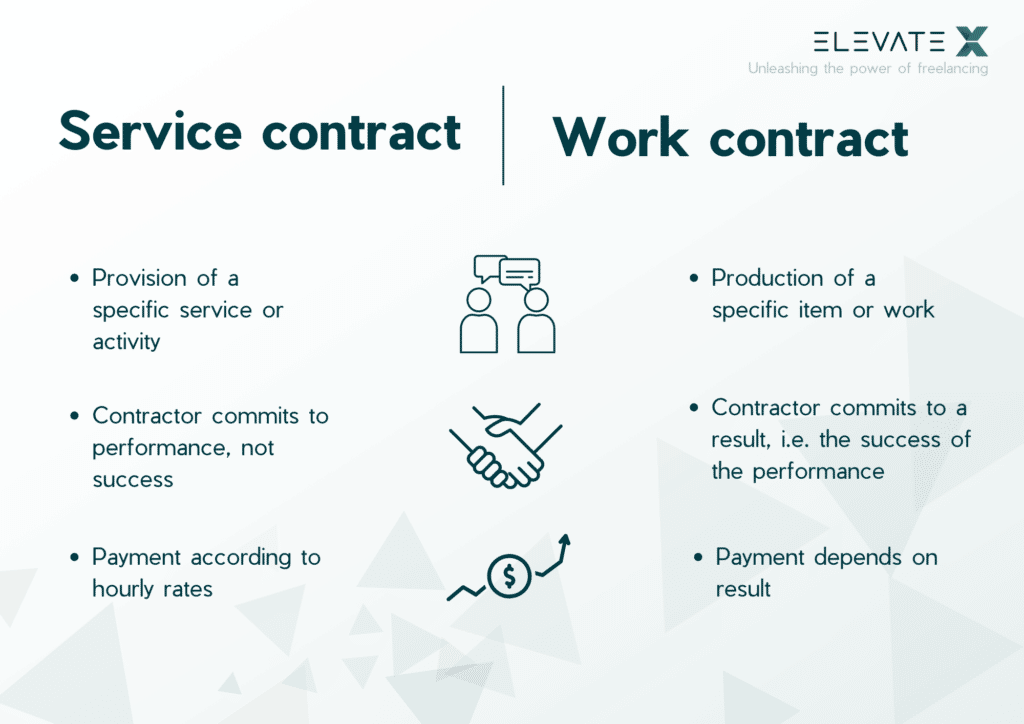

Types of Contract: Freelance Employees and Free Employee

Although contracts for work and services are similar, they are legally subject to different conditions. The service contract is based on §§ 611 ff. BGB, while the contract for work and services is governed by §§ 631 ff. BGB. The pure designation of the contract, on the other hand, is legally subordinate; what matters is the content, i.e. the expression of the will of both contracting parties.

Roughly speaking, there are the following differences: In the contract for work and services, it is agreed that the freelancer will perform a specific work, a specific work for the company. Here, the success of the work is owed. If the work is not completed to the target, the contract is not fulfilled.

The service contract, on the other hand, is aimed more at the efforts of the freelancer. Success does not necessarily have to be achieved. The contractual fee must be paid in any case, as long as there has been no lack of serious effort on the part of the freelancer.

In practice, service contracts are often concluded for training activities and freelance work, while contracts for work are concluded with commercial self-employed persons. In addition to the names and addresses of the contracting parties, the contents of the contracts include the agreed service, the duration of the employment or the scope of the project, and the amount and manner of payment. Equally important are paragraphs that apply in the event of non-performance of the contract.

- Work Contract: a specific performance must be achieved

- Service Contract: has the freelancer’s effort as its basis

Working Successfully With Free Employees: Define Goals

Free employees open up new aspects for companies. They bring expertise, insider knowledge and versatile perspectives with them through their previous assignments. From an economic point of view, it is also interesting for companies to generate free employees. Here, they are only paid for what is actually performed. The work ethic of free employees is predominantly positive. Those who are suitably qualified choose their projects. The level of personal commitment is correspondingly high.

Free Employees and Core Staff: Promoting Team Building

Certainly, there may be one or the other project where one or more free employees are successful without the involvement of permanent employees. In many cases, however, the know-how of the permanent staff is important, especially when it comes to existing structures, networks and working modalities. Entrepreneurs who put together the right teams here win. A permanent contact person for questions that arise about the project or as a link between free employees and company management is also an advantage.

Reduce Prejudices: Integrate Free Employees

Anyone who is afraid of sensitive company data being leaked to third parties sometimes has to worry about this more with permanent staff than with free employees. Those who work on their own account know very well that even the slightest suspicion of a breach of trust could be the end of their career. Ultimately, a confidentiality agreement provides the legal assurance that all points regarding discretion and confidentiality, which are in principle self-evident, are strictly adhered to.

Nor do companies have to worry about free employees appropriating the word “free” for themselves. Clearly defined work objectives, knowledge of operational working methods and friendly cooperation are the cornerstones on which the collaboration between permanent employees and external free employees succeeds.

Record Successes and Experiences: Documentation and Knowledge Transfer

In order to be able to look back on work steps even after the end of a free employees collaboration, precise documentation is important. Detailed records are equally helpful in order to have helpful basics at hand for later contracts and projects. What worked well, what was missing, what could be improved? Only when all of this is in writing will companies rely on and hire free employees again for future projects.

Free Employees: Typical Industries

To put it bluntly, it is primarily the companies in which there are regular fires. Partly, an unforeseeable workload is the reason, partly highly qualified employees are needed at short notice. IT is one of the industries where freelancers are important. Likewise, advertising agencies, media and media design, design, and marketing are areas that rely on the cooperation and assistance of free employees.

Advantages and Disadvantages: Free Employees in the Company

The advantages are clear: free employees are sought when there is actually work for them. Companies do not have to comply with any labor law requirements. When the contract ends, so does the collaboration. All costs for free employees can be calculated in advance.

The greatest disadvantage for companies arises when a bogus self-employment arises from freelance work. In this case, financial claims can be expected, penalties can be imposed and the cooperation can end abruptly for this reason. It should also be borne in mind that free employees may be absent due to illness, perhaps promising more before the contract is signed than they are willing or able to deliver. However, these hurdles can usually be avoided if the contract is checked carefully before it is signed.

- Advantages free employees: only for individual projects and when there is a real need, labor law does not apply

- Disadvantages: Financial problems in case of established bogus self-employment, complete absence in case of illness.

What Taxes Does A Freelancer Pay?

A freelancer is subject to various tax regulations that affect their income. The following are the main taxes that a freelancer must pay.

Income tax is the fundamental tax paid by freelancers. This tax is levied on the income earned by the freelancer through their professional activities. The amount of income tax depends on the level of income and is calculated according to the applicable tax rate.

In addition to income tax, freelancers in many countries also have to pay social security contributions. These contributions serve to finance social protections such as pension insurance, health insurance, and unemployment insurance. The amount of social security contributions varies depending on the country and the individual income situation of the freelancer.

Furthermore, there may be additional taxes that apply to freelancers depending on the nature of their activities and their location. These may include value-added tax (VAT), which is levied on goods and services, and trade tax, which is imposed on commercial income in some countries.

It is important to note that freelancers often have the right to deduct certain expenses from their taxable income. These may include professional expenses such as office supplies, office rent, or travel costs. These expenses reduce the taxable income and can therefore reduce the tax burden.

To fulfill the tax obligations as a freelancer, it is advisable to keep accurate records of income and expenses and consult a tax advisor when needed. A tax expert can help understand tax obligations, take advantage of possible tax benefits, and correctly fill out tax returns.

Overall, a freelancer must pay income tax, social security contributions, and potentially other specific taxes that may vary from country to country and from situation to situation. It is important to inform oneself about the specific tax laws and regulations in one’s own country and, if necessary, seek expert advice to fulfill tax obligations correctly.

Wrap Up

In summary, one of the main characteristics of the free employee is that he is not integrated into the company. Moreover, he does not receive an employment contract but mostly a service or work contract. It is also important for the free employee not to fall into bogus self-employment. This can happen quickly if the free employee only works for one company. For companies, a free employee has many advantages. For example, the costs can be calculated in advance and no labor law requirements have to be taken into account.

They are booked for specific jobs to support companies with their special skills. Compared to permanent employees, they have to pay their own pension and health insurance. They also do not receive an employment contract but a service or work contract.

The main difference is that a self-employed worker is a tax law designation and a free employee is simply considered a temporary employee. Article § 18 EstG of the tax law clearly defines who falls under the term freelancer.

On the one hand, there is the contract for work. In this contract, it is agreed that the free employee will perform a certain work for the company. Here, the success of the work is owed. If the work is not completed successfully, the contract is not fulfilled. There is also the service contract. This, on the other hand, is aimed more at the efforts of the free employee. Success does not necessarily have to be achieved. The contractual fee must be paid in any case, as long as there was no lack of serious effort on the part of the free employee.