You have a dream of working for yourself and potentially even being fully independent of where you are, but you have no idea how to go about making that dream a reality. That’s Freelancing. But what about the stages involved in registering your freelancing work and your business? Here’s everything you need to know about freelancer registration in Germany.

What Is a Freelancer? – Quick Recap

A freelancer is an individual who earns money on a per-job or per-task basis, usually for short-term work as an independent contractor. A freelancer is not an employee of a firm and may therefore be at liberty to complete different jobs concurrently by various individuals or firms unless contractually committed to working exclusively until a particular project is completed.

Examples:

- Data entry

- Software programming & beta testing

- Website Design

Unlike an employee, a freelancer is not subject to set working hours and is not required to adhere to the organization’s spatial and content-related standards. A freelancer could be required to do specific services that have been requested by their client. However, it is the freelancer’s responsibility to plan and organize his job. This does not, however, prohibit an arrangement on how the work is to be done between the corporation and the freelancer.

A freelancer chooses his hours, schedule, and location.

When Is Self-employment Considered As Freelance Work?

Taxable freelance work is regulated by § 18 of the Income Tax Act and has been further specified through numerous rulings by the Federal Fiscal Court and letters from the Federal Ministry of Finance. In addition to the professions listed in the catalog of § 18 of the Income Tax Act, there are similar professions and activity-based professions that are also recognized there. The law itself does not contain detailed criteria and characteristics to specify each professional field.

Freelancer vs. Small Business vs. Trade

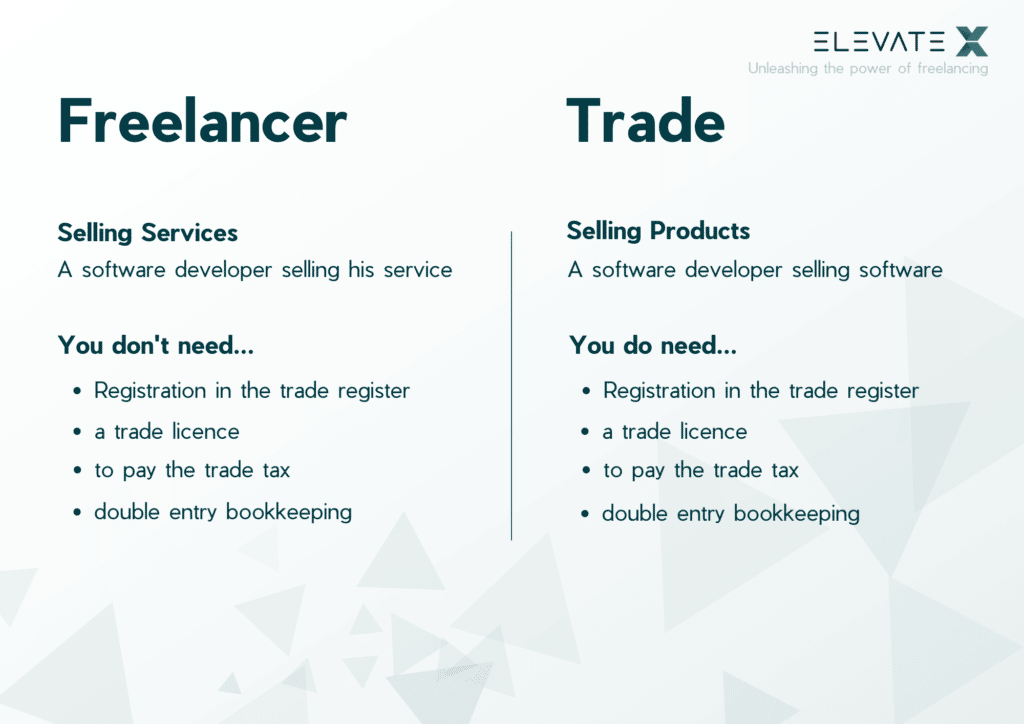

Freelancer

This title is used in Germany to describe independent, credentialed experts who market their services. Doctors, attorneys, accountants, engineers, and one of our clients, the IT specialists, who work for themselves are often Freiberufler.

You are not a Freelancer if you engage in goods sales. Software developers, for instance, are Freelancers if they provide services, but they are Gewerbes if they sell software.

Pros:

- The German Trade Register, the Handelsregister, does not require that you register1.

- No trading license is required (Gewerbeschein)

- The Gewerbesteuer (trade tax) is not due from you.

- Double-entry bookkeeping is not required.

Small Business

The phrase “small business” is most frequently used in relation to taxes.

You are only permitted to conduct business as a small business owner if your annual turnover was under 22,000 euros. Your overall turnover for the current year may not exceed 50,000 euros (small business regulation).

Small business is a word that derives from commercial and trade law. This implies that you are exempt from adhering to the Commercial Code’s extremely complex rules. You are exempted from double-entry bookkeeping, among other things. You can run a little business while working as a freelancer with relatively low sales.

- Annual sales (not including profits) are less than 22000 euros and 50000 euros in subsequent years.

- You are exempt from having to charge VAT to your clients. VAT is optional; however, it is not required.

- You’re unable to claim VAT refunds for company expenses.

Trade

You are a tradesperson if you are self-employed but not a freelancer (Gewerbetreibende). Websites and stores that deal in tangible goods are typically considered “Gewerbe”. Because they are not Freiberufler, independent delivery and call center personnel must also apply as a Gewerbe.

Businesses have a few unique responsibilities compared to independent contractors:

- They have to sign up with the trade registry (Handelsregister)

- They must pay the trade tax and submit an application for a trade license (Gewerbeschein) (Gewerbesteuer).

- Double-entry bookkeeping is required.

Which One Am I?

The tax office will decide for you after you submitted a document called “Fragebogen zur steuerlichen Erfassung”.

As of January 1, 2021, natural persons, legal entities, and partnerships must submit the “Tax Registration Questionnaire” to their relevant tax office within one month of opening a business or permanent establishment. This questionnaire must then be submitted electronically in accordance with the officially prescribed data record without being requested by the tax office. The previous obligation of the tax offices to request the questionnaire is thus eliminated and the entrepreneurs are obliged to submit the questionnaire electronically. The tax administration’s service portal ELSTER is to be used to fill in and submit the questionnaire unless the submission is made via a tax advisor. The use of ELSTER requires registration, which is needed anyway for the subsequent transmission of tax returns and tax declarations. It should be noted that registration takes approximately two weeks.

In the questionnaire for tax registration, in addition to general personal information (address, bank details, etc.), the start-up entrepreneur provides tax information on the scope of the expected sales and earnings of his commercial or self-employed activity. The information relates to an obligation to submit VAT returns or to the assessment of advance payments of income tax and, if applicable, trade tax by the tax authorities.

Freelancers are exempt from trade tax, but not from VAT. Exception: Freelancers who work according to the small business regulation are exempt from VAT.

Who Can Register a Freelance Activity

Everyone can technically become a freelancer. If you want to work in Germany as a foreigner, there are a few things to notice. It differentiates between setting up a business with a economic interest as well as an own capital to finance your business and on the other hand a freelance business. The following points are required:

- You can provide proof of sufficient funds to finance your projects.

- You have obtained any licenses required to perform the job in question.

- If you are older than 45 years of age, you must provide proof of adequate old age pension provisions.

As we already mentioned, the tax office will determine in the end, whether you’re registered as a freelancer.

Freelancer Registration in Germany - Step by Step

Letter to the Tax Office

To register as a freelancer, it is sufficient to draft an informal letter (like we showed you before) and send it to the local tax office. You already know that, but in some places, there are several tax offices – you can find out which jurisdiction you belong to on your tax return, for example. The Federal Central Tax Office can provide more detailed information.

Register before the first job to avoid any irritations.

The following data must be included.

- Name

- Address

- Contact details (telephone number, e-mail address)

- The date on which the self-employed activity is started

- Description of the activity performed

- Tax identification number

State Your Qualifications

- Freelancers must also show documentation of their professional credentials.

- For the proper execution of numerous freelance tasks, sufficient training is required.

Insurance

Anyone who starts working for themselves is no longer covered by their employer’s social insurance and must get their own insurance. However, freelancers need insurance for more than just health and accidents. It’s also a good idea to purchase liability and property insurance, as well as to consider retirement planning. Particularly crucial insurances include the following:

- Health protection

- Accident protection

- Old-age benefits

- Employment-based disability insurance

- Insurance for professional liability

- Liability insurance for businesses

- Corporate legal defense

- Commercial content insurance

Both statutory and private health insurance are options when it comes to health coverage. As a self-employed individual, you must convert to voluntary insurance if you want to enroll in mandatory health insurance. There are many tariff types in the private variant as well. The general rule is that the smaller the required payments, the less will be refunded.

Featured: For an even more detailed guide, look at this article.

How to Become a Freelancer – 7 Things to Consider

Self-Assessment

Consider your abilities and the industries you wish to work in. Make an effort to address any issues that clients may have for which you could be of assistance.

Market Research

Become familiar with the current state and potential future direction of the market in your sector and research the market to assess risks and possibilities.-

Legal Form

The legal structure that you need relies on your unique professional goals, your circumstances, the economic climate, the potential for collaboration, etc. You should always consult a tax lawyer or notary, as well as a possible tax consultant, before making any decisions.

There are a few different forms:

- Sole proprietorship with unlimited liability (freelancer, small business)

- Sole proprietorship with limited liability (GmbH, UG)

- Civil law partnership (GbR)

- Partnership company (PartG)

In addition, gather some information about the legal forms.

Finances

Freelancing is not equivalent to having a fixed job. You are more accountable to yourself and take a bigger risk. In addition, keep an eye on your funds, including a reasonable hourly rate and ongoing expenses.

A significant benefit is that you do not have to pay trade tax because you are exempt from the trade requirement as a freelancer. Additionally, you don’t require double-entry bookkeeping; a straightforward income statement would do.

Equipment

You don’t have a set place of employment and typically work from home or another distant location. Read this article to learn how to set up a productive workspace on your own four walls.

Attract Interest

One of the most crucial elements is having a significant web presence. Create profiles on well-known business networks like Xing or LinkedIn so that people can find you there. Your website, which lists your credentials, expertise, and experience, is frequently a useful professional tool.

Also, Freelance marketplaces like ElevateX are suggested. You can find interesting projects there, and we promise a seamless working relationship with renowned clientele.

Closing

Following the completion of a project, you must create an invoice.

- Pay close attention to the normally required information and try to avoid leaving any room for questioning. Be open to dialogue!

- If you obtained the project through ElevateX, we will discuss the financial details with you and serve as your point of contact.

Which Taxes Do Freelancers Have To Pay?

Freelancers are subject to certain tax obligations that need to be considered. The following are some of the most important taxes that freelancers usually have to pay:

- Income Tax: As a freelancer, income is generally considered as profit from self-employment and is therefore subject to income tax. The profit is calculated after deducting business expenses and possible allowances.

- Value-Added Tax (VAT): If the freelancer is liable for VAT, they must charge and remit VAT on their services to the tax office. The VAT rate varies depending on the area of activity and is usually 19 percent in Germany.

- Trade Tax: Although freelancers are usually exempt from trade tax, there are some exceptions. If the freelance activity exhibits commercial elements, it may be necessary to pay trade tax. It is advisable to clarify this with a tax advisor.

- Income Tax Prepayments: Freelancers are usually required to make quarterly income tax prepayments. These serve to “prepay” the expected tax liability for the tax year and avoid liquidity constraints at the end of the year.

- Solidarity Surcharge: The solidarity surcharge is an additional levy on income tax that finances tasks related to German reunification. Freelancers must pay the solidarity surcharge if their taxable income exceeds a certain threshold.

It is important to note that tax obligations and duties may vary depending on the country and individual situation. Therefore, it is recommended to consult a tax advisor to fulfill the specific tax obligations as a freelancer correctly and to optimize potential tax benefits. Careful bookkeeping and documentation of all income and expenses are also crucial to properly carry out the tax return.

Wrap Up

To create a successful business, a founder needs to possess specific administrative and business skills in addition to having a solid idea. Additionally, a variety of soft skills are crucial. If you got all these and feel confident in your abilities, you register your business to official governmental offices, in most cases the tax office. They will determine your status as a freelancer or (small) business. After the paperwork, your journey to independency begins.

Everyone can technically become a freelancer. If you want to work in Germany as a foreigner, there are a few things to notice. You can provide proof of sufficient funds to finance your projects and have obtained any licenses required to perform the job in question. If you are older than 45 years of age, you must provide proof of adequate old age pension provisions.

Taxation is the sole distinction. Here, there are two sizable categories: (a) Trader as Unternehmer and (b) Freelancer as Freiberufler. Einzelunternehmer, or “single proprietor,” is a category “b” designation. You are able to work as a freelancer or an entrepreneur under any category.

Your formalities are free if the tax office defines you as a freelancer (Freiberufler). The registration price ranges from 15 euros (online registration) to a maximum of 31 euros if you are categorized as an entrepreneur (Unternehmer) or tradesman (Gewerbe) (registration happens directly at a trade office or public order office).

Consider the following scenario as an example: You only have one client as a freelancer. Your self-employment is similar to regular employment in that you work regular hours, days, and locations in the office (no remote work). We can assume that this situation involves phony self-employment. What are the options? Have multiple employers or work for a middleman who can connect you with a number of clients. Find more information in our dedicated article.