There are the same insurances for self-employed as for employees. The difference, however, is the responsibility you bear for your insurance coverage as a self-employed person. Self-employed people have to insure themselves against risks during their work, as you do not have an employer to cover the financial consequences of any damage. Therefore, ensuring that you are well-insured as a self-employed person is very important.

What Insurances Are There For Self-employed People?

Various insurances protect you against the financial consequences of the following three types of damage/risks:

- damage to your person (illnesses, accidents) or your property (household goods, business inventory)

- liability damages

- legal disputes

As different as these damages or situations are, they have one thing in common: They can significantly affect your self-employment and, in the worst case, threaten your financial existence and mean the end of your career. However, with the right insurance for the self-employed, this risk can be significantly minimized.

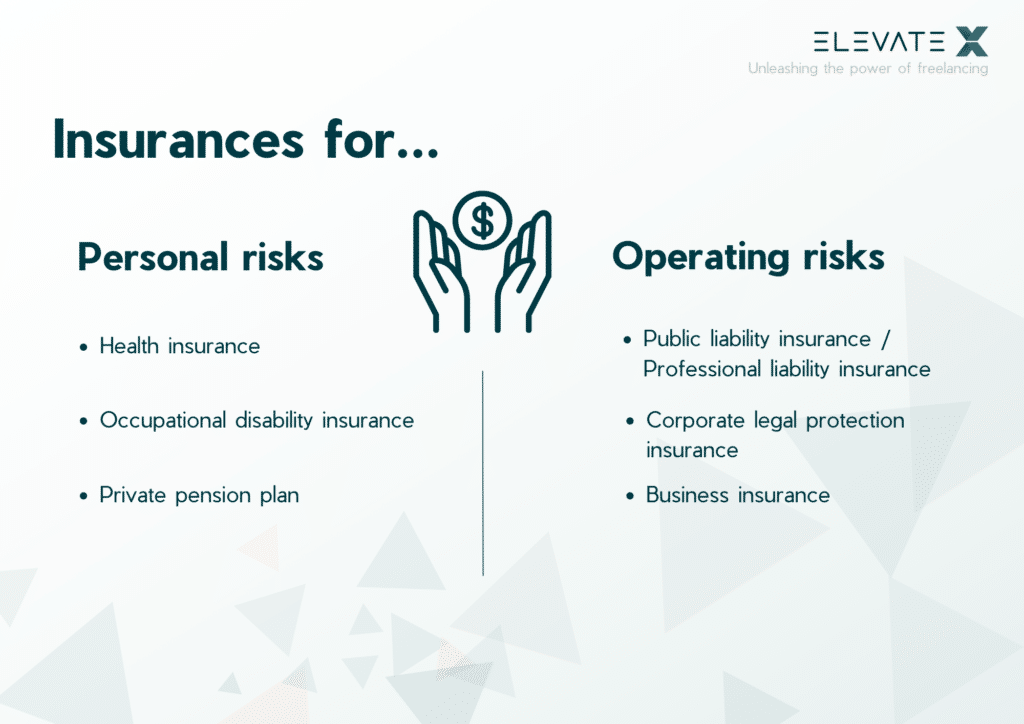

Potential damages or risks can be divided into two groups: personal (private) and business risks. Behind each of these are different risks that you, as a self-employed person, should cover with appropriate insurance policies in order to be financially secure in the event of damage.

KEY POINTS

- Basically, potential losses or risks can be divided into two groups: personal (private) and business risks.

- A loss can have devastating financial consequences for the self-employed, which in the worst case can threaten their financial existence.

- In Germany, health insurance is compulsory, irrespective of the professional activity performed.

- Insurance companies do not differentiate between self-employed or freelancers.

Covering Personal vs. Business Risks

As a self-employed person, you need to cover yourself against both personal and business risks. Because a loss can have devastating financial consequences for the self-employed, which in the worst case can threaten their financial existence. Therefore, it is important to prevent this eventuality with the appropriate insurance policies and cover all crucial personal and business risks.

Personal/private risks include all risks that affect you as a person. This includes your health, your life and your belongings. You can cover these personal risks with the following insurances:

- Health insurance

- Disability insurance

- Private pension plan

Business risks are risks that are associated with or can occur in the normal course of business. They can affect your business premises as well as certain activities and can be covered by the following insurances, among others:

- Business liability insurance / Professional liability insurance

- Company legal protection insurance

- Business insurance

Not every insurance policy is equally important or useful for the self-employed. A perfect insurance cover is always individual, because it protects the most important risks of the individual as well as possible, so that there is no over- or underinsurance.

Is It Necessary To Distinguish Between Freelancers And Self-employed Persons When It Comes To Insurance?

Self-employed or freelancer – even though the terms are sometimes used synonymously, they each mean something different. This distinction is legally significant, as the following summary shows:

The generic term “self-employed” refers to persons who are not employed, but work on their own account. Depending on the activity, the legislator distinguishes between tradesmen and freelancers. Tradespeople include, for example, all craft businesses, commercial and industrial enterprises. They require a trade license and are obliged to pay a trade tax.

As a freelancer you are working on a freelance basis. There is no limitation to certain industries here. Freelancers usually work for a company on a self-employed basis for the duration of a specific project, sometimes also in parallel for different projects or companies. The activity is usually agreed in a service or work contract, but you work independently and usually determine working hours and locations yourself.

Insurance companies do not distinguish between self-employed or freelancers. However, there are differences as to which insurances are obligatory for whom, which are strongly recommended and which are of secondary importance.

What Are Mandatory Insurances For Self-employed Persons?

All self-employed persons in Germany must have the following insurances:

- Health insurance

- Nursing care insurance

In Germany, health insurance is compulsory, regardless of the professional activity of the person. In other words, whether employed or self-employed, everyone must have health insurance. However, when it comes to health insurance, the self-employed can choose between statutory and private health insurance. In order to become a voluntary member of a statutory health insurance, you must have been previously insured as an employee. As a satutory health insurance member, you are automatically also in the nursing care insurance, for which there is also an insurance obligation. If you choose private health insurance, you must purchase separate nursing care insurance because the two policies are not linked.

Every professional activity is associated with specific risks. Therefore, some insurances are only obligatory for certain occupational groups. The following overview provides an initial (not complete) orientation of industry-specific mandatory insurances that may be mandatory for self-employed persons in these professions:

Healing professions (e.g. doctors, pharmacists, nurses, midwives):

- Professional liability insurance

- pension insurance

- product liability insurance

Craft professions and home trades:

- Pension insurance

- Accident insurance

Planning professions (e.g. architects, engineers):

- Professional liability insurance

Education and training:

- Pension insurance

Consulting professions (e.g. lawyers, notaries, tax consultants):

- Professional liability insurance

- Pecuniary loss liability insurance

Artistic professions:

- Pension insurance

In addition, there are many special regulations for compulsory insurance for certain professions, such as insolvency insurance for tour operators, carrier insurance for freight forwarders or public liability insurance for security services. Some professional chambers (e.g. Chamber of Crafts, Chamber of Industry and Commerce) prescribe additional insurances for individual occupational groups. Therefore, be sure to check with your chamber to find out whether you require a specific insurance policy.

When Do Self-employed Persons Not Need Compulsory Insurance?

In the case of pension insurance, which is mandatory for self-employed persons in certain professions (e.g., trades, nursing, educational professions), there are exceptions who are exempt from mandatory insurance. These include, among others, persons who

- are self-employed in an educational profession and employ employees subject to compulsory insurance

- have already paid into the pension insurance for 18 years (or longer) as self-employed craftsmen and apply for a contribution exemption

- have been self-employed for less than 3 years and have only one client

- earn a maximum of 450 euros per month

- are already retired

Tip: If you are not sure whether you are subject to compulsory pension insurance or whether you are exempt from it, simply ask the German pension insurance. Or get information from your responsible chamber. In any case, act early to avoid later additional payments or even fines due to late payment.

Looking for projects?

Additional Insurances For Freelancers

Some of the following insurances are mandatory for certain professions. However, they make sense for most freelancers, so it is worth taking a look at the insurance coverage or benefits they offer:

Pension Insurance / Private Retirement Provision

As a self-employed person, you are responsible for your retirement provision. And you should take this responsibility seriously, because without it you risk old-age poverty, which is widespread among the self-employed. You can prevent this by paying into the statutory pension insurance, taking out private pension insurance, taking advantage of state support through the basic pension or investing in real estate or other tangible assets. Each form of retirement provision has advantages and disadvantages, so be sure to seek advice on which form is best for you.

Accident Insurance

Accident insurance protects you from the financial consequences of an accident. It covers the costs that you incur in the event of disability due to an accident, for example, for the conversion of your home or business premises to make them suitable for the disabled, or for wage compensation.

Business Liability Insurance

This insurance covers property damage, personal injury and consequential property damage caused by you (or your staff) or your products or occurring on your business premises. Typical example: A customer trips over a cable in your store and is injured.

Financial Loss Liability Insurance

This insurance protects you against claims for damages that may be made by a person who has suffered financial loss as a result of a mistake made by you. The pecuniary loss liability insurance is particularly useful (and therefore partly obligatory) for all self-employed persons who are active in planning and consulting and have to take high financial risks. This includes, among others, architects, appraisers, collection agencies, trustees or real estate managers.

Professional Liability Insurance

This insurance covers you against personal injury, property damage or financial losses caused in the course of your work. It can be understood as a combination of business and property damage liability. Professional liability insurance is available in very different variants for specific industries, tailored to the needs and risks of the respective professions.

Business Interruption Insurance (loss of earnings insurance)

This insurance ensures that running costs (e.g. rent, wages) are paid even if operations have to be temporarily interrupted. Possible reasons for business interruption include theft, fire, or a forced closure such as many businesses experienced in the lockdown during the Corona pandemic.

Legal Insurance

No one is immune to litigation, and should the business dispute end up in court, it can be costly. A commercial or corporate legal expenses insurance policy will then cover the legal fees and court costs. Often, the costs for expert opinions and out-of-court settlements (e.g. mediation) are also included in the insurance benefits.

Conclusion

There are various personal (private) and business risks that represent a significant financial burden for the self-employed and, in the worst case, a threat to their financial or professional existence. With the right insurances you can protect yourself against these risks. The most important is health and long-term care insurance, which you – like every employee – are obliged to take out.

Depending on your occupation, there are other mandatory insurances that you must have. These include pension insurance, professional liability insurance and financial loss liability insurance. In addition, other insurances protect you from the financial consequences of potential damages. Typical examples are accident insurance, business liability insurance, business insurance or legal expenses insurance.

There is no general answer to the question of which insurance the self-employed need. The optimal insurance coverage depends on many factors (industry, activity, etc.) and should therefore always be tailored to your individual needs. In the best case, the insurance cover provides comprehensive protection without over-insurance.

Self-employed persons must cover both private and business risks. For this purpose, all insurances that can also be taken out by employees are available to them. In addition, there are special insurances for the self-employed with which you can cover individual risks of your company. The most important insurances include

- Health insurance for the self-employed

- Disability insurance, accident insurance

- Pension insurance, private old-age provision

- Property insurance (e.g. household insurance)

- liability insurances

- legal expenses insurance

All self-employed persons – just like employees – are subject to the statutory obligation to take out health insurance and long-term care insurance. In addition, depending on the occupational group, there are other compulsory insurances, such as pension insurance for teachers, accident insurance for home traders or insurance against financial loss for lawyers.

Personal risks affect you as a person. You can insure yourself against them with health insurance, pension insurance, occupational disability insurance, but also with personal liability insurance and household insurance.

Business risks, on the other hand, are risks that can occur in the course of day-to-day business operations. Among other things, coverage is possible through business and professional liability insurance, pecuniary loss liability insurance and legal expenses insurance.